Autonomous Vehicle OEM Launch Timelines, Penetration, and Forecast

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration & sales demand by levels of automation (level 1, level 2/2+2++, level 3, level 4 – highway, level 4/5 – ur

Published: 13 Jan 2020

Key Highlights

Interviews with 60+ stakeholders

Exhaustive Coverage

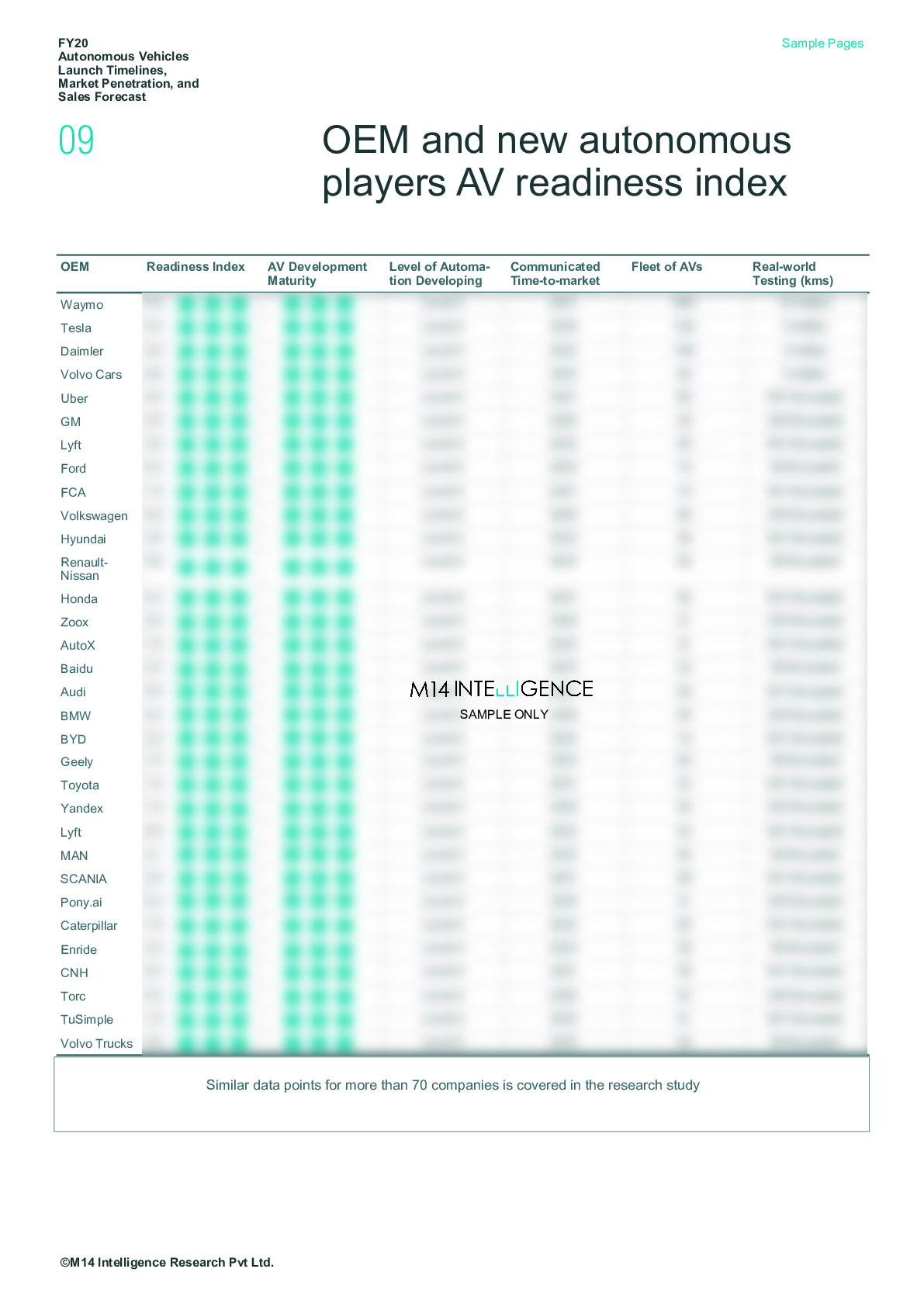

- Analysis of 70+ OEM brands both traditional and new autonomous players across passenger and commercial vehicles ecosystem.

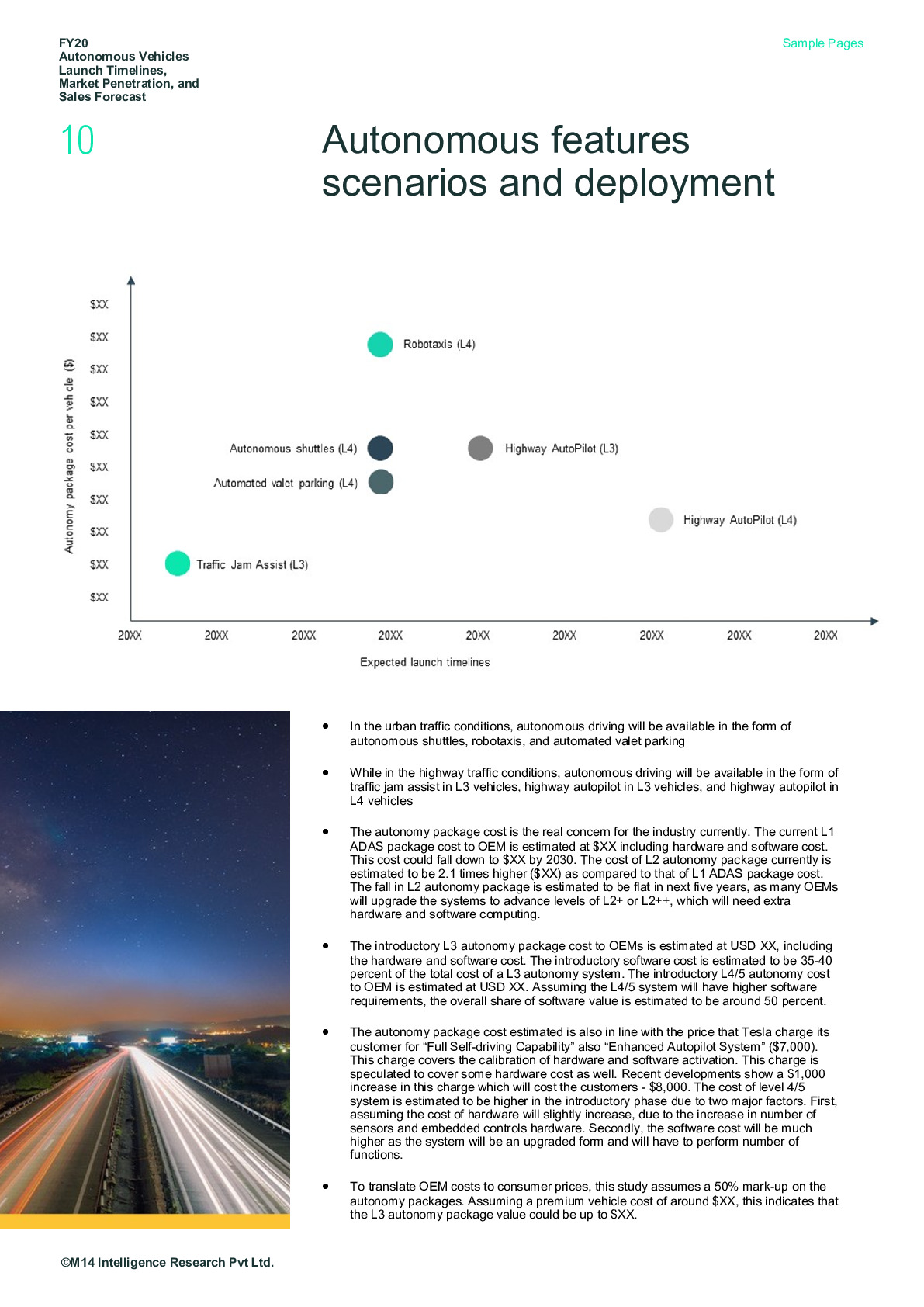

- Analyzing the communicated time-to-market for SAE level 3 and level 4 AVs with solutions such as highway autopilot, urban autopilot, and automated valet parking, among others by leading OEM brands and new AV players

- Analysis of on-demand AV fleet for mobility-as-a-service such as robotaxis, autonomous shuttle, pods, and delivery vehicles

- Analyzing the current status of automation in automotive industry, and identifying potential future demand for AVs till 2040

- Analyzing the market penetration of each SAE levels of automation across major automotive markets globally

- Identifying OEM strategies and markets for monetizing the AV

With this research, we aim to bring a fact-based evaluation of the AVs. As consultants, we also look forward to help you create your next go-to market strategy to position yourself as a key player in this swiftly evolving AV landscape.

Market Overview

Key Questions Answered

- What is the current status of vehicle automation in passenger and commercial vehicles industry?

- When will we see true autonomous driving on roads?

- Which companies will be the first to enter volume production of AVs?

- What are the different ways in which OEMs, Tier 1s, and new AV tech players going to monetize autonomous driving?

- What is the communicated time-to-market by the leading OEMs and tech companies?

- When is level 3 AVs expected on North American roads?

- How are the regulatory frameworks being developed across major automotive markets?

- What is the status of Chinese AV industry developments? And how are the Chinese OEMs, tech players, and Tier 1s approaching autonomy?

- Which markets are expected to drive the demand for AVs?

- How will autonomy be introduced first in robotaxis, shuttles, pods, and autonomous delivery vehicles?

- Which markets are expected to have highest market penetration of autonomy?

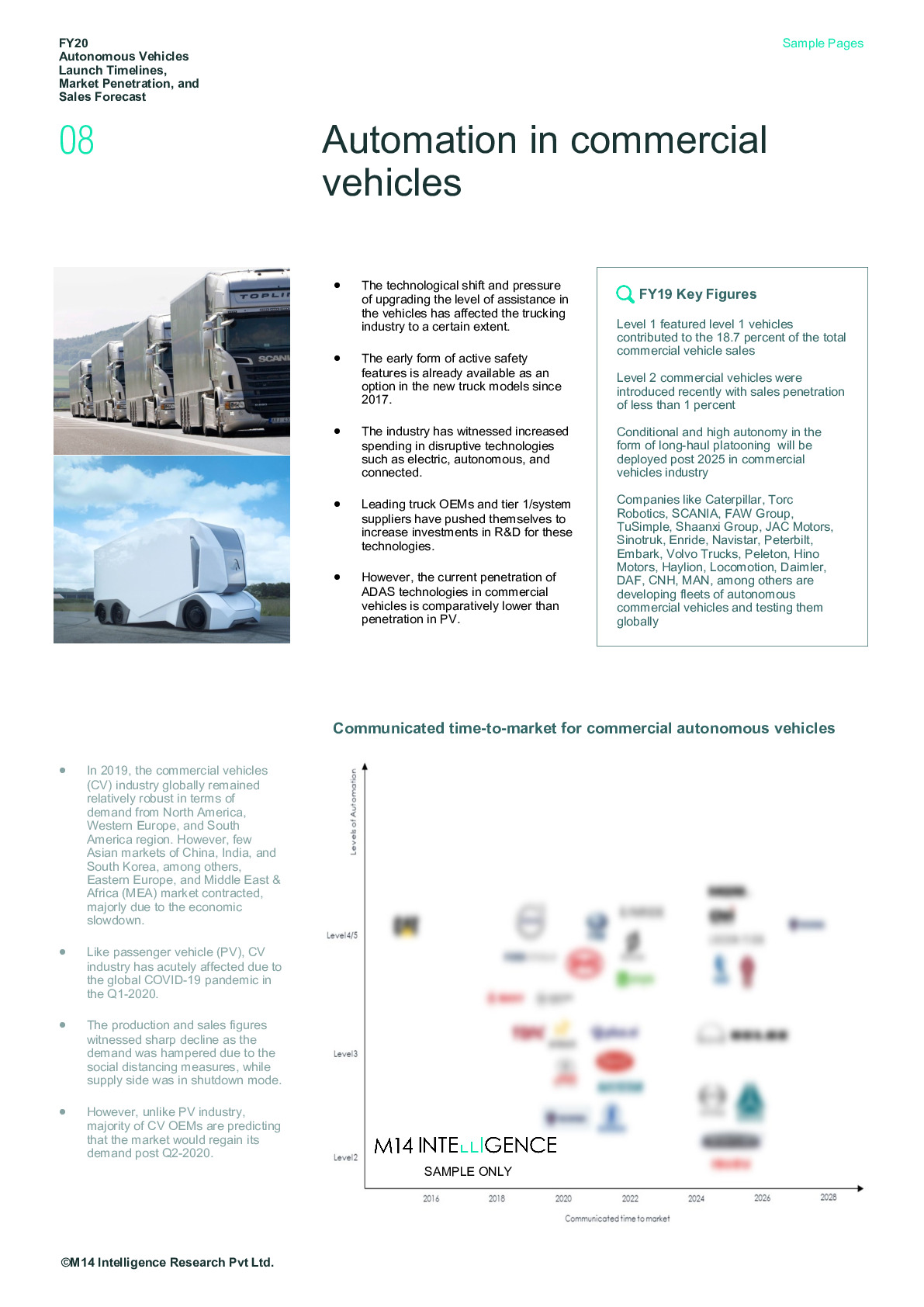

- How is autonomy being developed in commercial vehicles industry?

- Who are the leading players in robotic vehicles ecosystem, ADAS passenger vehicles ecosystem, and ADAS commercial vehicles ecosystem?

- How is the market penetration of different levels of autonomy change in major economies?

- What is the projected sales demand for all the levels of autonomy in major automotive markets?

- At what AV development stage are the leading OEMs and AV tech players?

- When will level 4 autonomy be introduced in private vehicles?

List of Companies

*not an exhaustive list

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)