Container Terminal Automated Equipment and Technologies Market, Edition 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Industry Analysis, and Automation Trends, 2021 to 2030.

Published: 09 Apr 2021

Key Highlights

- More than 250 pages of analysis

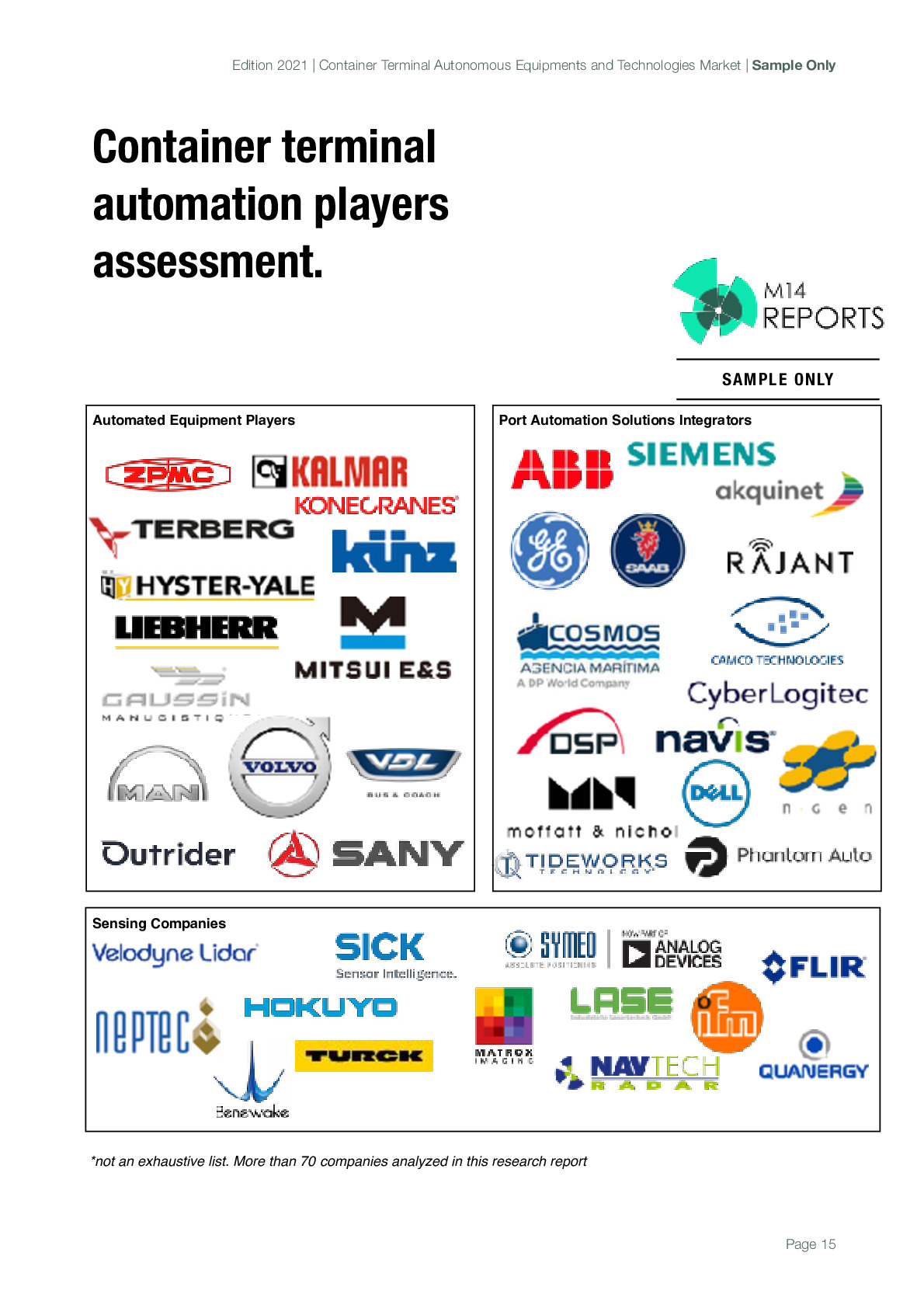

- 70+ companies analyzed in the ecosystem

- 60+ critical data tables on penetration, sales demand, and pricing

- Deep company profiles of more than 30+ key players

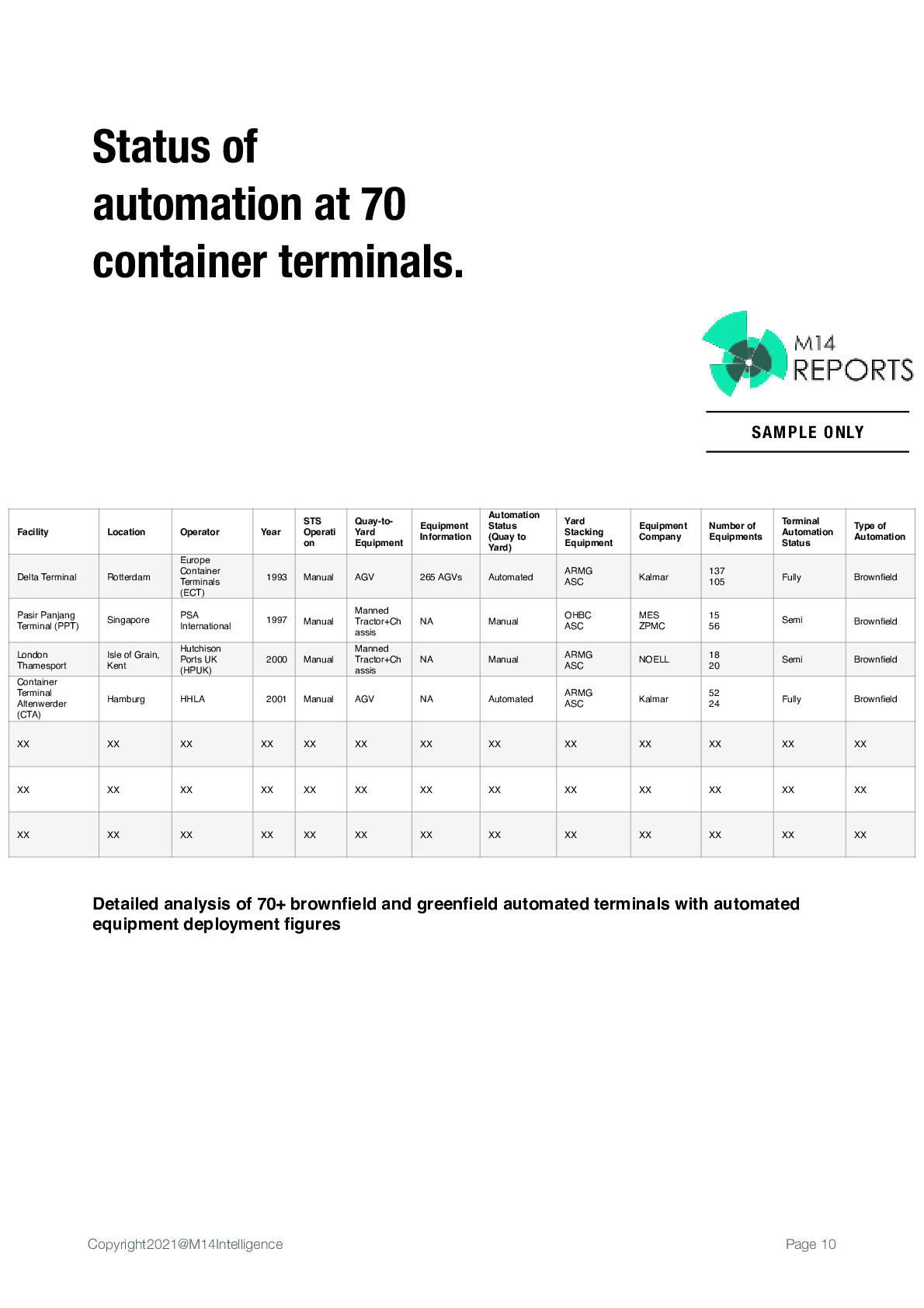

- Analysis of brownfield and greenfield automation projects

- Analysis of semi-automated and fully automated terminals

- Analysis of LiDAR, camera, and radar sensing market for automation

Exhaustive Coverage

This research study is an outcome of 3 months of desk research on digitization and automation of container terminals across the globe. The report exhaustively talks about the more than 100 terminal automation projects conducted in the last decade to evaluate the trend within container terminal industry for greenfield and brownfield automation; semi-automated and fully automated terminals; technologies defining the automation, automated equipment from quay to yard to gate.

This report helps the reader with the following core industry trends –

- Future trends in automation of container terminals

- Trends in brownfield and greenfield automation

- Industry acceptance for semi-automated to fully automated terminals

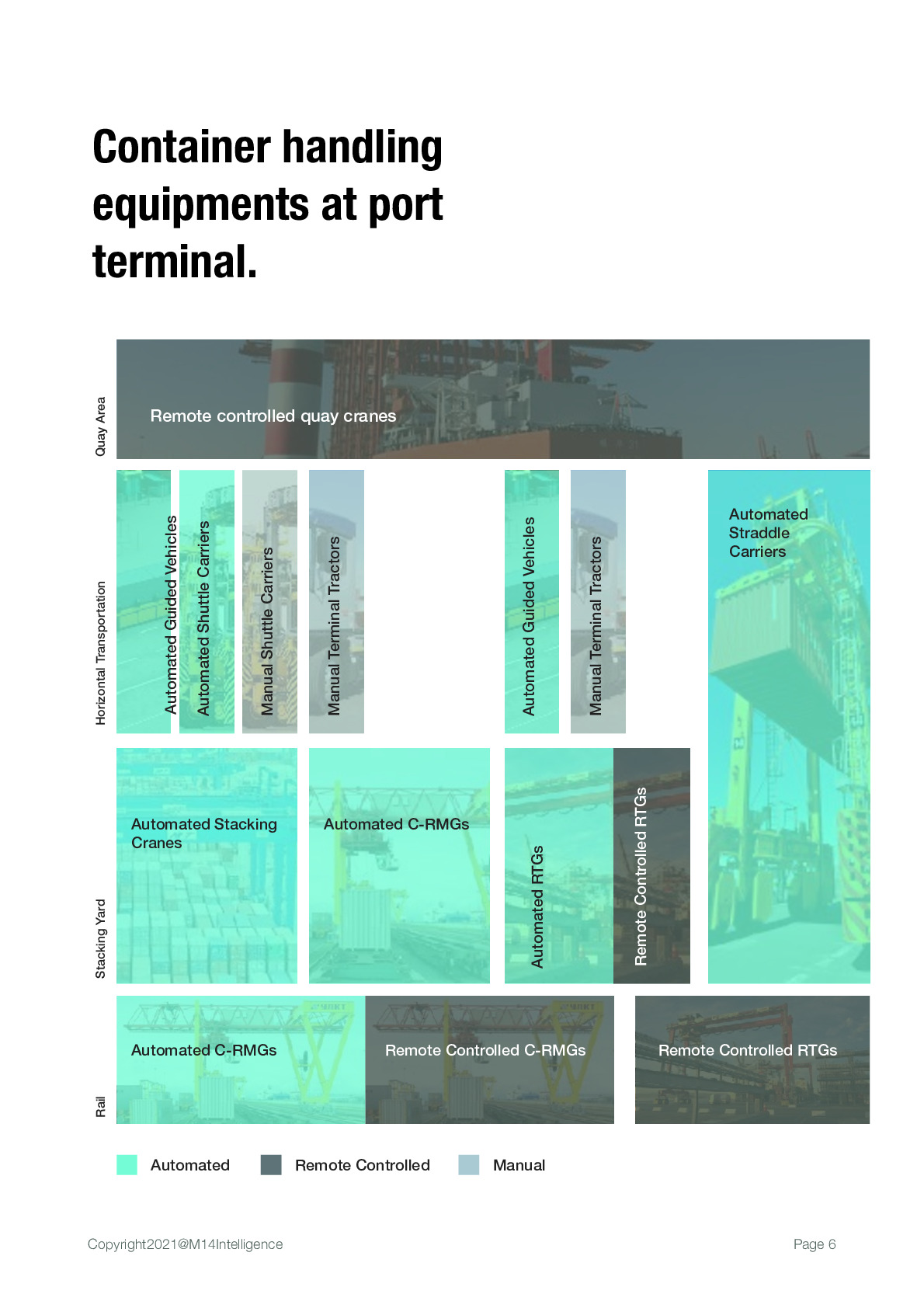

- Trends towards adopting automated terminal equipment such as automated stacking cranes, automated straddle carriers, automated terminal tractors, automated rail-mounted gantry cranes, automated rubber tyred gantry cranes, and automated guided vehicles

- Market forecast of terminal automation including automated equipment, autonomous solutions and site management services, sensing technologies including camera, radar, and LiDAR sensors

- Analysis of leading players across the supply chain of terminal automation industry including players such as port operators, autonomous equipment manufacturers, automation companies (including hardware, software, and both), automation service providers and integrator

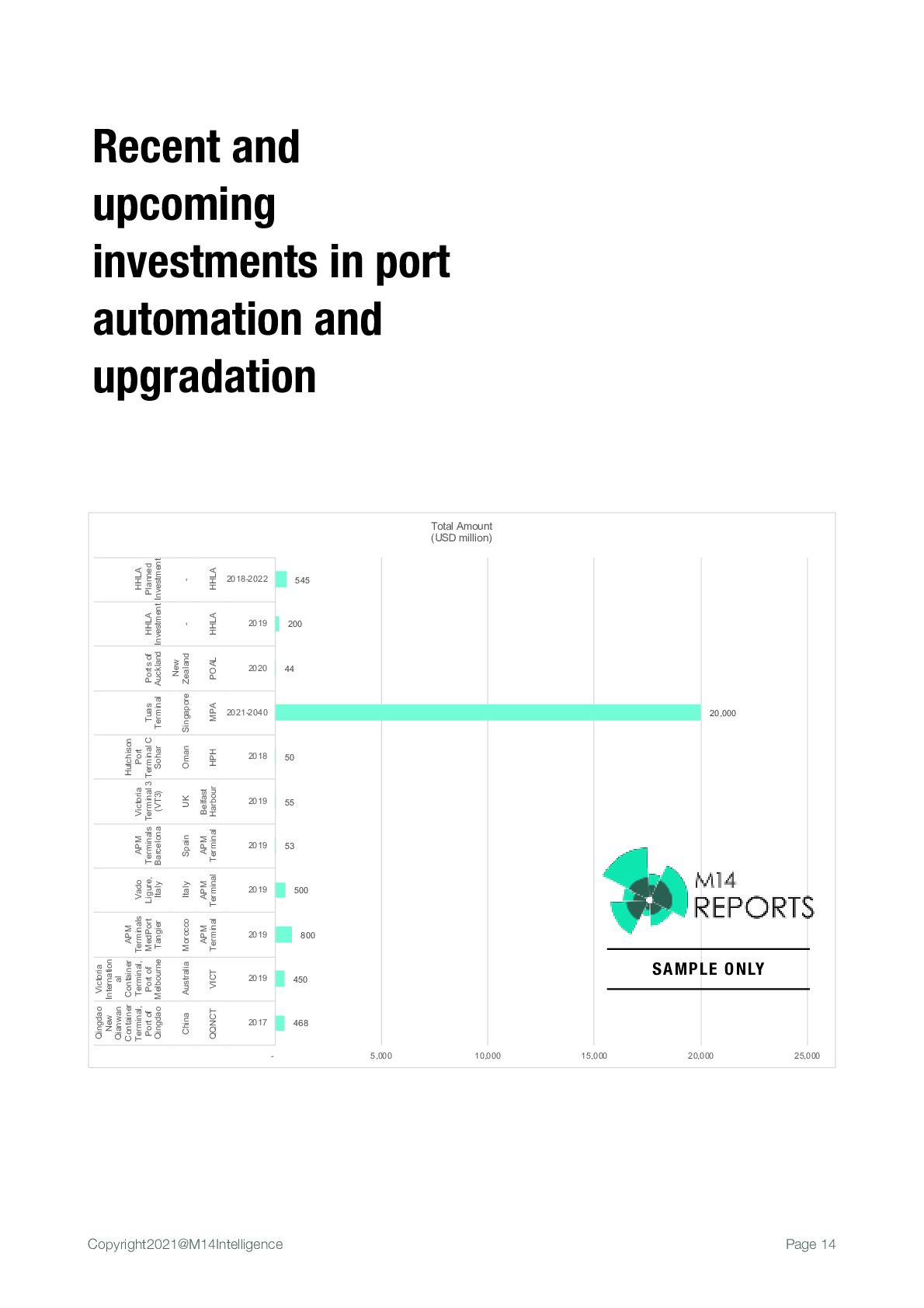

- Analysis of industry trends by evaluating the recent investment and funding announced for future automation projects, important M&As, and key partnerships redefining automation in the container terminals

Market Overview

Despite the economic downturn of last year due to the pandemic, many ports have seen significant increase in the total throughput in terms of TEU in 2020. However, ports are now increasing facing congestion problems, labor issues, and increasing competition. Alongside these challenges, container handling remains one of the most dangerous operations in the industry. The introduction of digitization, remote handling, and automation in handling containers and equipment is a response to all these pressures. Unmanned handling of the containers clearly means there is an increasing need towards sensing technologies.

Although the level of automation and safety in container terminals has increased considerably in this decade, today there are just 66 automated container terminals worldwide of which only 20 are fully automated while the rest are semi-automated terminals. This is just 4 percent of the total container terminals worldwide.

From the optimistic view this means there are almost 96 percent container terminals yet to witness automation of any kind which indeed is a great opportunity for everyone in the ecosystem – right from the container handling equipment manufacturers to technology providers, to automation integrator. The report helps the reader with the total addressable market for the equipment players, technology companies, and automation integrator in terms of total number of ports to be semi or fully automated in mid and long term, the total deployed base of automated equipment and future sales forecast of these equipment, total brownfield and total greenfield automation projects (historical and future).

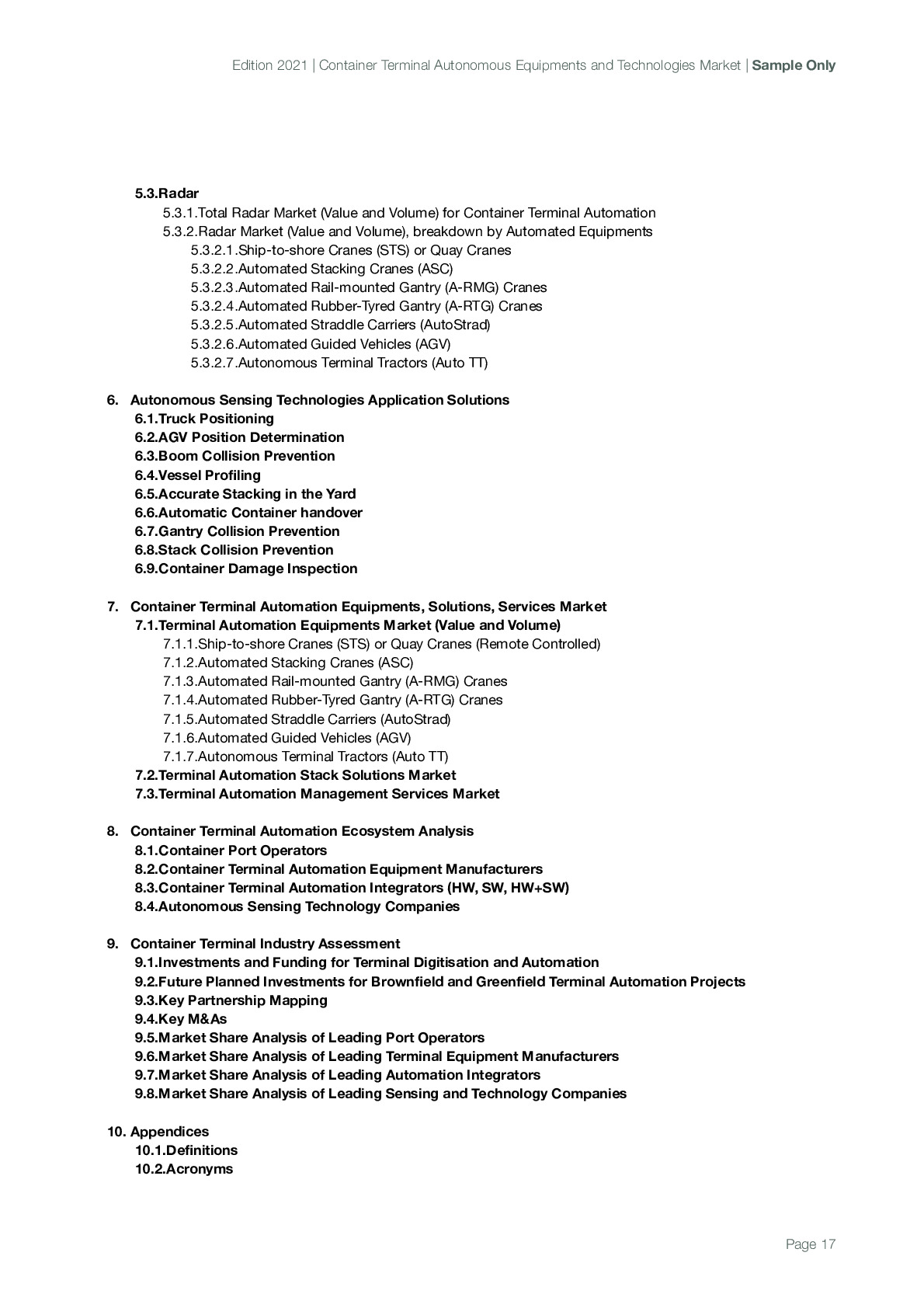

The report has analyzed six container handling equipment with automated functionalities including automated rail-mounted gantry (A-RMG) cranes, automated rubber tyred gantry (A-RTG) cranes, automated stacking cranes (ASC), automated straddle carriers (AutoStrad), automated guided vehicles (AGV), and semi-automated and automated terminal tractors (Auto TT). The report forecast the sales volume, pricing trends, and market size of each of these equipment and further analyses the market size (value, volume, and ASP) of technologies (camera, radar, LiDAR) used for autonomous functionalities.

Key Questions Answered

List of Companies

This is just a sample list and not exhaustive list of companies covered in this research study. Please download the sample document for more information on companies researched.

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)