ADAS & AV Technologies and Components Market, Edition 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS, HD maps, AI, processors, and software computing and sub-component hardware

Published: 03 Jun 2020

Key Highlights

- Analyzing the current status of ADAS technologies and its developmental trends towards autonomous driving

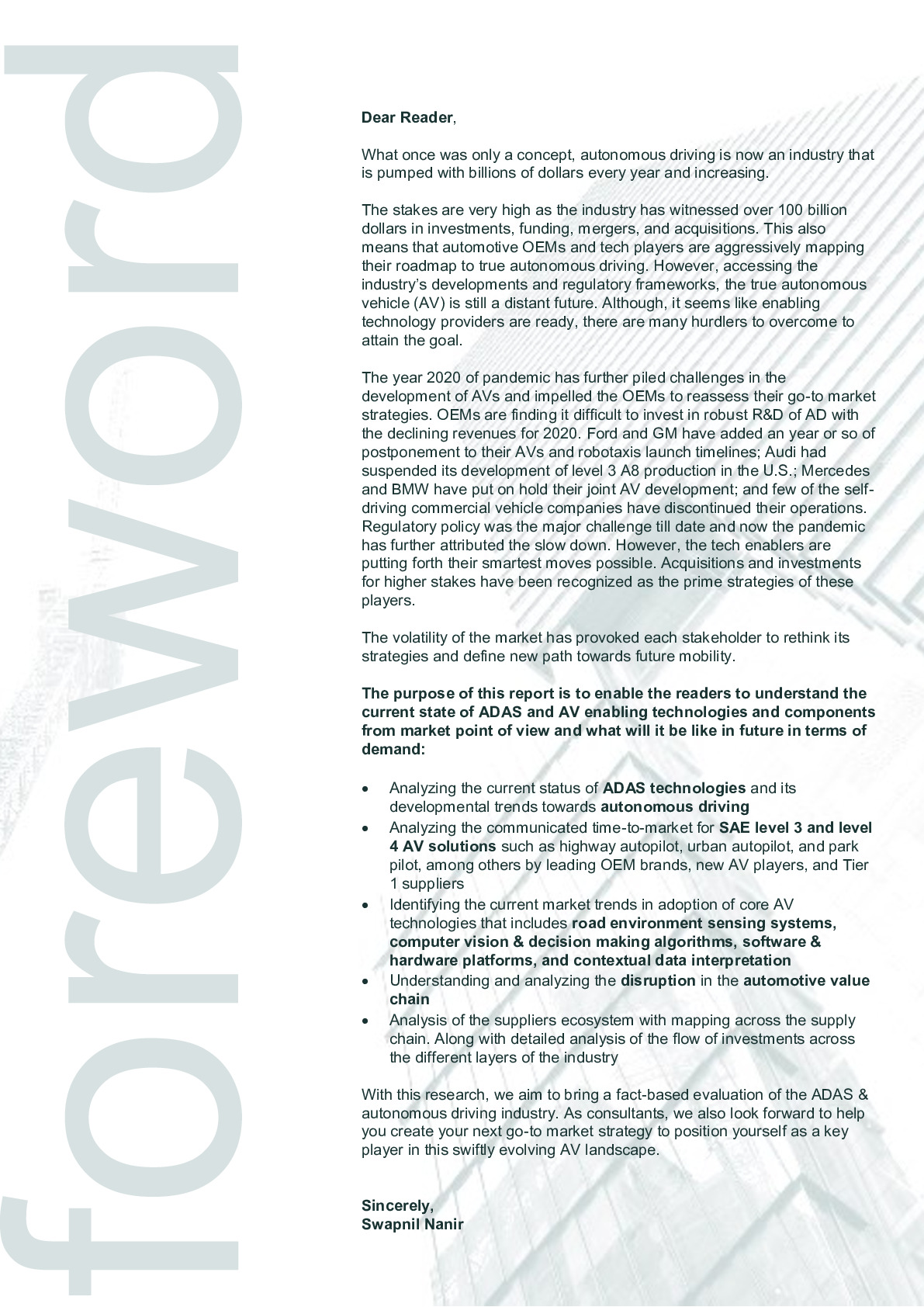

- Analyzing the communicated time-to-market for SAE level 3 and level 4 AV solutions such as highway autopilot, urban autopilot, and automated valet parking, among others by leading OEM brands, new AV players, and Tier 1 suppliers

- Identifying the current market trends in adoption of core AV technologies that includes road environment sensing systems, computer vision & decision-making algorithms, software & hardware platforms, and contextual data interpretation

- Understanding and analyzing the disruption in the automotive value chain

- Analysis of the supplier’s ecosystem with mapping across the supply chain. Along with detailed analysis of the flow of investments across the different layers of the industry

- The report analyzes more than 300 companies across the different layers of supply chain

Exhaustive Coverage

- 3D sensing cameras for in-cabin and world-facing applications including in-cabin/driver monitoring/gesture recognition/occupant monitoring camera, forward ADAS/main camera, thermal camera, and surround-view camera system. Along with sub-component level analysis of CMOS Image Sensors, optics, & illumination sources

- Long-range and short/medium-range LiDAR sensing with respect to major technologies that includes mechanical scanning, OPA, solid-state, FMCW, 3D flash, among others. Along with the illumination and photodetection technologies

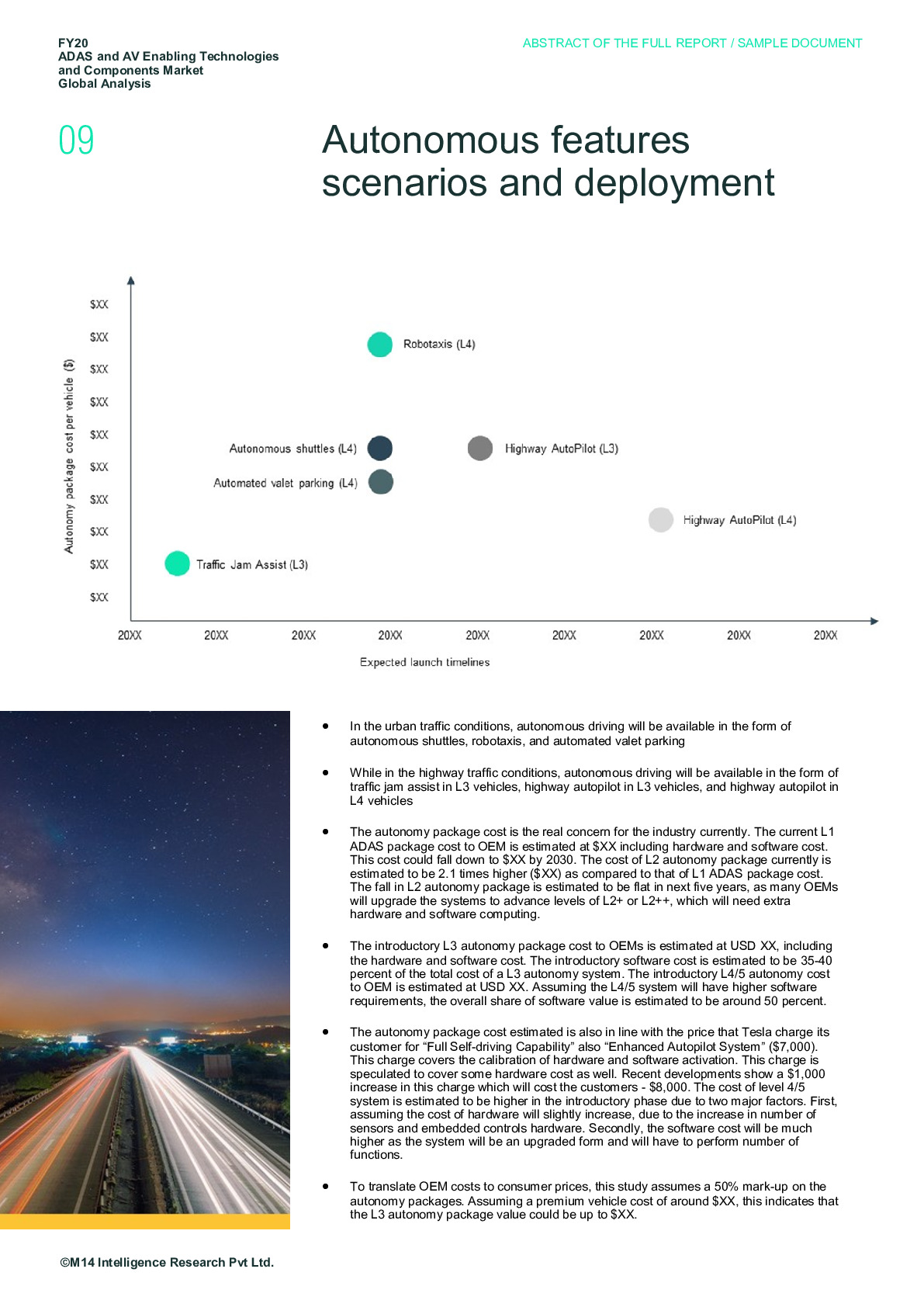

- Long-range and short/medium-range radar sensing systems

- High-precision GNSS/INS, HD maps, V2X, machine learning/AI, software stack, middleware, OS, computing hardware, data annotation, AV testing and simulation (SIL, DIL, HIL, VIL) technologies

- Demand analysis from the perspective of passenger and commercial vehicles specifically towards: robotaxis, autonomous shuttles/pods/delivery vehicles, long-haul platooning, level 3 highway pilot, level 4 highway pilot, level 4 automated valet parking

- Mapping of key suppliers in each technology category by levels of automation (level 1/2, level 2++/3, and level 4) and OEM brands

Holistic analysis of the combined impact of mega-trends on mobility such as automation, electrification, connected mobility, shared mobility, fleet services

Market Overview

Common consensus is that long-range LiDARs could be used as a third front facing sensor for additional redundancy in level 3 or level 2++ systems. While level 4 autonomous OEM vehicles and robotaxis might use combination of 4 to 8 medium and long range LiDARs. For instance, currently Waymo is installing 1-rooftop long-range LiDARs and 4-short/medium range LiDARs at the front and rear corners. Other great example is of Aptiv’s system used in Lyft’s fleet of autonomous vehicles. Aptiv uses combination of 5 long-range and 4 short-range LiDARs in their autonomous systems.

Key Questions Answered

- What is the current status of vehicle automation in passenger and commercial vehicles industry?

- When will we see true autonomous driving on roads?

- Which companies will be the first to enter volume production of AVs?

- What are the different ways in which OEMs, Tier 1s, and new AV tech players going to monetize autonomous driving?

- What is the communicated time-to-market by the leading OEMs and tech companies?

- When is level 3 AVs expected on North American roads?

- How are the regulatory frameworks being developed across major automotive markets?

- What is the status of Chinese AV industry developments? And how are the Chinese OEMs, tech players, and Tier 1s approaching autonomy?

- Which markets are expected to drive the demand for AVs?

- How will autonomy be introduced first in robotaxis, shuttles, pods, and autonomous delivery vehicles?

- Who will win the supplier race to autonomy?

- How are the key autonomous driving technologies evolving?

- What is the relevance and threat of LiDAR technology in autonomous driving? And where will it be used specifically?

- How will the LiDAR prices impact the overall sensor suite package price?

- How are camera technologies evolving and how are the suppliers sustaining in this competitive market?

- How are HD maps and GNSS playing important role in autonomous driving?

- How are the stack players aligning in this market?

- How are data annotation players placed in this market?

- Which machine learning/AI techniques will be used majorly in autonomous driving?

List of Companies

*not an exhaustive list. Please download the sample or contact to get sample/abstract document.

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)