Autonomous Vehicles in Logistics Industry (First, Middle and Last Mile)- Edition 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (LiDAR, Radar, Camera); Geographical Analysis, Autonomy Package Cost, Investment, and Competition

Published: 04 Apr 2023

Key Highlights

- The AVs market in logistics is a rapidly growing industry, driven by the massive growth in e-commerce and logistics post the Covid-19 pandemic, need for supply chain optimization, and labour shortage across geographies

- Consumer demands for free shipping, shorter delivery time, contact-less deliveries are few of demand-side factors attributing to the larger acceptance for the autonomous driving in last-mile operations

- The automation is expected to show increasing penetration over the years in the middle-mile operations as the demand from consumers for rapid, inexpensive, and predictable deliveries is surging

- Autonomous technology penetration in class-8 trucking has predominantly increased since past 2 to 3 years. Close to $4 billion funding has been recorded in autonomous trucking industry since 2016

- Robotic delivery services or automated deliveries are emerging as a viable path toward commercial scale and profitability. The autonomous technology penetration in last-mile delivery business has a potential to cut the cost up to 52% in short-term and up to 75% in long-term

- The United States is a clear leader in developing and deploying autonomous vehicle technology, accounting for 94% of the total North America’s volume shipment of autonomous logistics vehicle

- In terms of setting standards and national level policies, China is taking this on high priority and evolving at faster pace. More than 20 smart highways are scheduled for construction across 13 Chinese provinces, promoting the testing and application of AV technology, especially for autonomous trucking

- Legislation in the European Union has completed defining the framework conditions for the use of fully automated trucks (SAE Level 4). Some autonomous driving vehicles are already rolling on European roads with special permits. The Western European countries account for 90% of the Europe’s autonomous vehicle market currently

- This autonomous vehicle market in logistics industry is highly fragmented, with several stakeholders including OEMs, technology players, software and AI companies, system integrators, sensor providers, consumers such as shipping companies, e-commerce players, food delivery giants and logistics companies

Report in numbers –

125+ pages of analysis on Autonomous Logistics Vehicle penetration market and forecast

More than 30 Players (leading and emerging) analyzed

More than 20 consumer companies analyzed

70+ data tables and infographics on market analysis

Interviews with 30+ stakeholders

Analysis of top markets including US, China, Japan, Germany, France, and other countries

Exhaustive Coverage

- Analysis of 30+ OEM brands both leading and emerging players across Logistics ecosystem.

- Analyzing the penetration of autonomous vehicles in first-mile, middle-mile, and last-mile logistics operations and growth potential.

- Analysis of market with respect to vehicle types such as autonomous level 4/5 trucks, on-road mini-vans, and sidewalk wheeled robots.

- Analyzing the current status of autonomous driving technology in logistics industry, and identifying potential future demand till 2030.

- Analyzing the market potential for sensors used in autonomous driving system i.e. cameras, short-range and long-range radars, short-range and long-range LiDARs, 4D Radars, and ultrasonic sensor

- Identifying consumers adoption strategies and regional market potential for autonomous vehicles

- Analyzing investment/funding analysis of start-ups and technology providers

With this research, we aim to bring a fact-based evaluation of the autonomous logistic vehicles. As consultants, we also look forward to help you create your next go-to market strategy to position yourself as a key player in this swiftly evolving industry.

Market Overview

Most of the AV start-ups have reallocated their capitals from passenger carriers to good carriers. Autonomous technology penetration in class-8 trucking has predominantly increased since past 2 to 3 years.

Close to $4 billion funding has been recorded in autonomous trucking industry since 2016.

China’s Inceptio Technology, dealing in autonomous driving truck technology and operation has raised highest funding till date compared to its peers. The company has recently closed $188 million Series B+ equity financing round to introduce more mass-produced L3 and L4 self-driving truck models to the market. In 2021, Aurora Innovation, TuSimple, and Embark launched their Initial Public Offering (IPO) and went public. These three leaders in the autonomous trucking business have cumulatively raised ˜$1.5 billion in funding. Plus.ai has raised $520 million over 5 funding rounds, with latest of $220 million from ClearVue Partners and FountainVest Partners. Pony.ai and Waymo are leaders already in the robotaxi market and have recently unveiled their entry in autonomous trucking and logistics market.

Waymo has raised funding of $2.25 billion from external investors, post which it formally announced the launching of Waymo Via, autonomous trucking segment. The investment pumped for this segment is estimated to be around $500 million. In latest Series D funding round of undisclosed amount, Pony.ai is estimated to have raised around $100 million for its robotruck product.

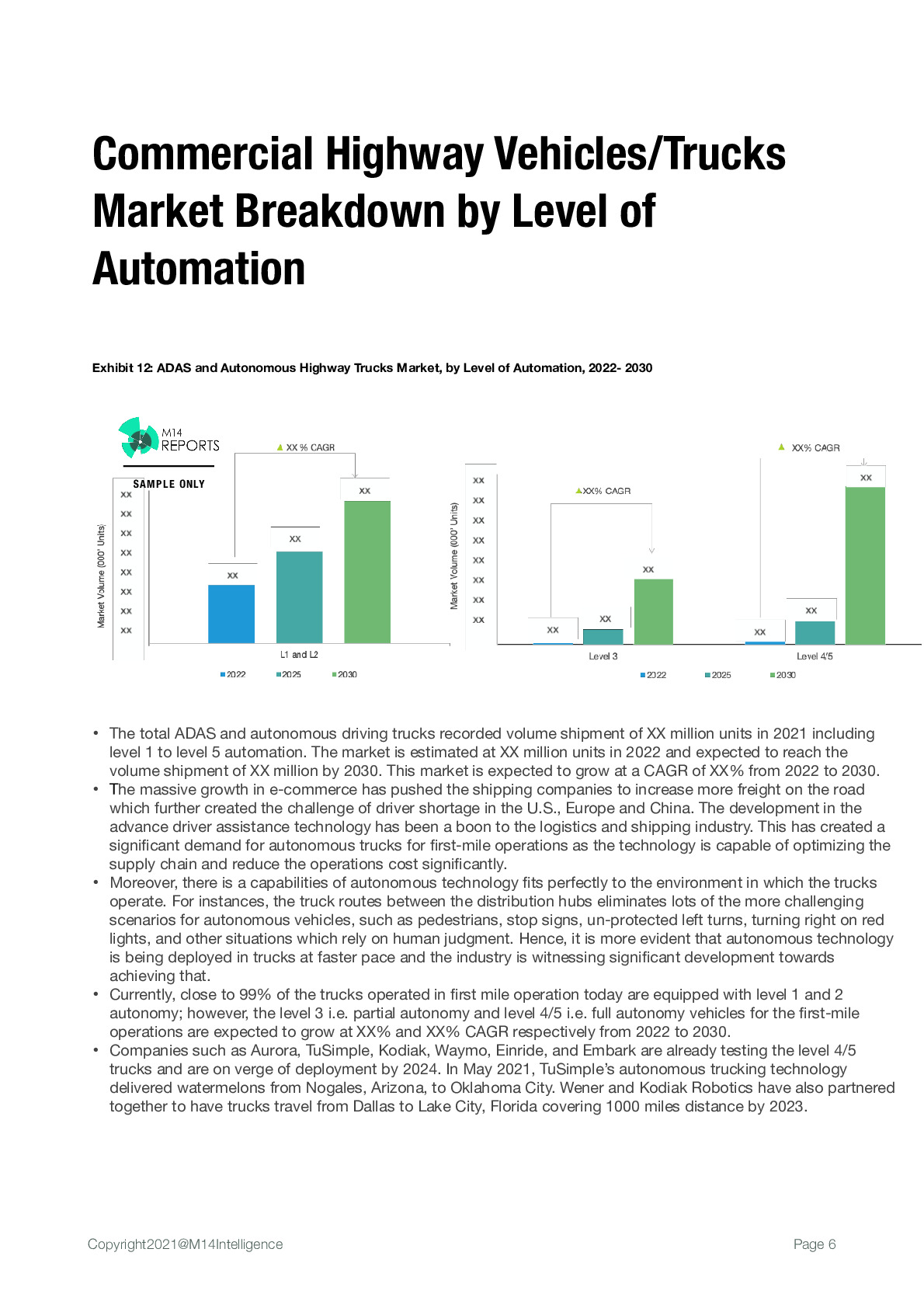

The massive growth in e-commerce has pushed the shipping companies to increase more freight on the road which further created the challenge of driver shortage in the U.S., Europe, and China. The development in the advance driver assistance technology has been a boon to the logistics and shipping industry. This has created a significant demand for autonomous trucks for first-mile operations as the technology is capable of optimizing the supply chain and the reduce the operations cost significantly.

Moreover, the capabilities of autonomous technology fits perfectly to the environment in which the trucks operate. For instances, the truck routes between the distribution hubs eliminates lots of the more challenging scenarios for autonomous vehicles, such as pedestrians, stop signs, un-protected left turns, turning right on red lights, and other situations which rely on human judgment. Hence, it is more evident that autonomous technology is being deployed in trucks at faster pace and the industry is witnessing significant development towards achieving that.

The autonomous tech has penetrated not only into the highway trucking but also into the intra city transportation of goods from warehouses to the stores. Since 2020, the autonomous technology has also penetrated into the last-mile operations of the supply chain. Many start-ups have emerged in this space targeting the food and grocery deliveries directly to the consumers involving smaller droids of 20 to 50 lbs. According to M14 Intelligence analysis, the autonomous technology penetration in last-mile delivery business has a potential to cut the cost up to 52% in short-term and up to 75% in long-term. Although the penetration of autonomous technology in quite low at present, however, the demand is expected to grow dramatical over next 5 years. In terms of volume, the autonomous logistics vehicles (L4 and L5) are anticipated to grow at a CAGR of 87% from 2022 to 2030. The industry is expected to witness a dramatic spike in the volume of autonomous vehicles in 2024 and 2025, as OEMs and technology companies have set their launch timelines during the same period.

The United States is a clear leader in developing and deploying autonomous vehicle technology. The country’s autonomous logistics vehicles volume shipment is estimated at xx units in 2022 and expected to reach xx million units by 2030. In the U.S., both the federal government and states have issued AD-related regulations, helping companies to progress towards commercialization. According to NHTSA, there are total 121 testing sites currently being permitted for testing of autonomous vehicles, of which 14 highways, 7 Universities, 5 Business campuses, and 2 sidewalk or pathways are dedicatedly being used to test autonomous logistic vehicles. Companies including Yandex, TuSimple, Valeo North America, Nuro, Locomation, Kodiak Robotics, Gatik AI, Embark, and Aurora Innovations are full-fledged working towards testing and deploying autonomous technology on these permitted U.S. roads.

According to American Transportation Research Institute’s data, driver costs on and average 42% of total freight revenue. The introduction of autonomous technology into freight transportation has the capability to reduce this cost significantly. Moreover, fuel efficiency is critical for road freight transportation, the application of autonomous technology in trucks could achieve around 10% reduction in the fuel consumption. The advent of autonomous technology can alleviate the constraints on the supply side and fulfill the unmet demand in road logistics. The average selling price of level 4/5 highway trucks is currently estimated at $xx and with mass production and commercialization, the ASP is expected to decline to $xx.

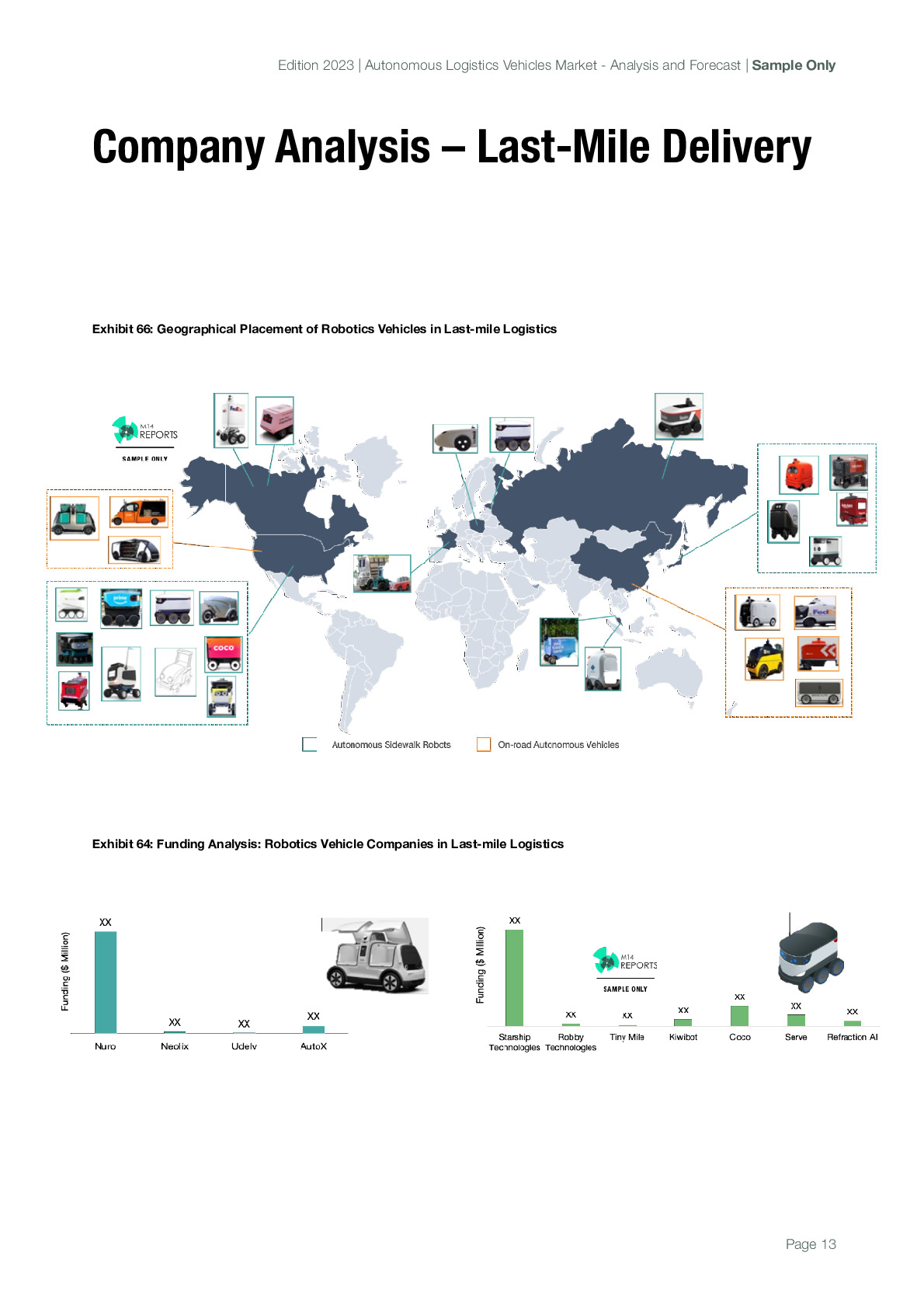

The package and food delivery industry has witnessed tremendous growth, recording $150 billion in 2021. Moreover, there is no shortage of funding for the continued development of sidewalk delivery technology as billion-dollar partnerships leveraged among many of the existing and upstart transport, and tech companies including FedEx, Amazon, Yandex, Magna International, Uber Eats, 7 Eleven, Co-op, JD.com, and Alibaba. The average cost of one fully autonomous sidewalk robot is estimated at $xx which is expected to further reduce over the years as the industry reached mass-production and commercialization stage.

Unlike the Robotaxis or the autonomous passenger vehicles, autonomous trucks have thrived through technological challenges and regulatory policies. Autonomous trucks are now a crucial part of supply chains’ first-mile delivery segment. The start-ups in this segment have progressed exponentially with billions of dollars of investments from venture capitalists and tech giants, while few of them have become public in matter of just 5-6 years. The leader in this space includes TuSimple, Plus.ai, Embark, Aurora, Kodiak Robotics, and Einride.

Quite few companies have realized the loopholes of the supply chain and have taken steps to optimize the ‘middle-mile’ delivery stage of logistics industry by deploying autonomous electric vans. Gatik, the U.S. based start-up is currently dominating the U.S. middle-mile logistics market by partnering with e-commerce giants such as Walmart. While NuPort has wide reach over the Canadian market with government funding. Torc is a subsidiary of Daimler Trucks and together the companies are progressing towards accelerating the deployment of autonomous vehicles for B2B applications and optimizing the supply chain cost.

Last Mile delivery is the most critical part of the supply chain as it involves direct contact with the customers. Post Covid-19, the demand for autonomous, contactless, and on-demand deliveries have boomed and players such as Starship Technologies, Kiwibot, Udelv, JD Logistics, Neolix, Nuro, and others have very satisfactorily served the customers with their small autonomous delivery robots/vehicles. Multiple robotics start-ups have entered this last-mile delivery segment since past 2 to 3 years as it holds high growth prospect.

Key Questions Answered

- What is the current status of Autonomous Vehicles in Logistics industry?

- What growth potential does this technology holds in coming 5 to 10 years?

- Which factors are attributing to the growth of AV market and what is the degree to impact?

- How is the market penetration of autonomous logistics vehicles in major economies?

- How is the market potential for autonomous vehicles in First-mile, Middle-mile, and last-mile operations?

- Which vehicles amongst the autonomous trucks, on-road delivery vehicles, and sidewalk robots have highest demands?

- Which companies are leading in terms of testing and deployment and which companies are the entering the market?

- What is the autonomy package cost of autonomous logistics vehicles?

- What is the sensor content for each type of autonomous logistics vehicles?

- What are the entry barriers for the start-ups and how much growth potential does this sector holds?

- How much funding or capital investment has been made in autonomous logistics vehicle segment over past 3 years?

- Which markets are expected to drive the demand for autonomous logistic vehicles?

- Which geographic markets are expected to have highest penetration of autonomous logistics vehicles?

- What is the projected sales demand for all types of autonomous vehicles in logistics industry?

List of Companies

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)