ADAS and Autonomous Driving Technology Market, Edition 2019

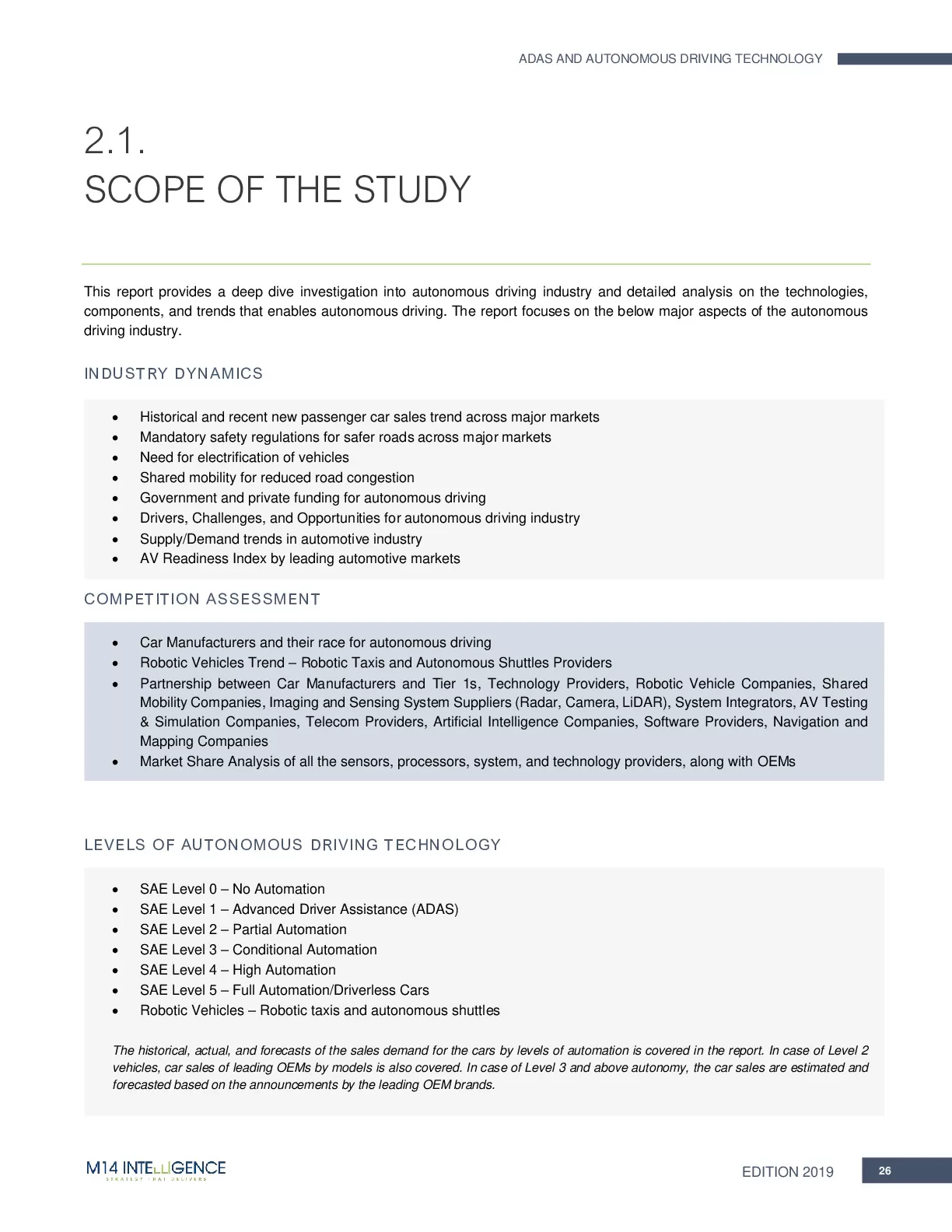

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot – Robotaxis, Shuttles, Pods); Market Size, Sales, & Pricing Analysis of AV Sensors (Camera, Radar, LiDAR)

Published: 10 Jul 2019

Key Highlights

This is a second edition of ADAS and autonomous driving market in the series. The first edition of this research report was the most recognized research study for its exhaustive and comprehensive analysis. This report is an updated version of edition 2018 with updated market numbers and forecast with detailed analysis on the trend and timelines of autonomous vehicles launch.

- More than 300 pages of analysis

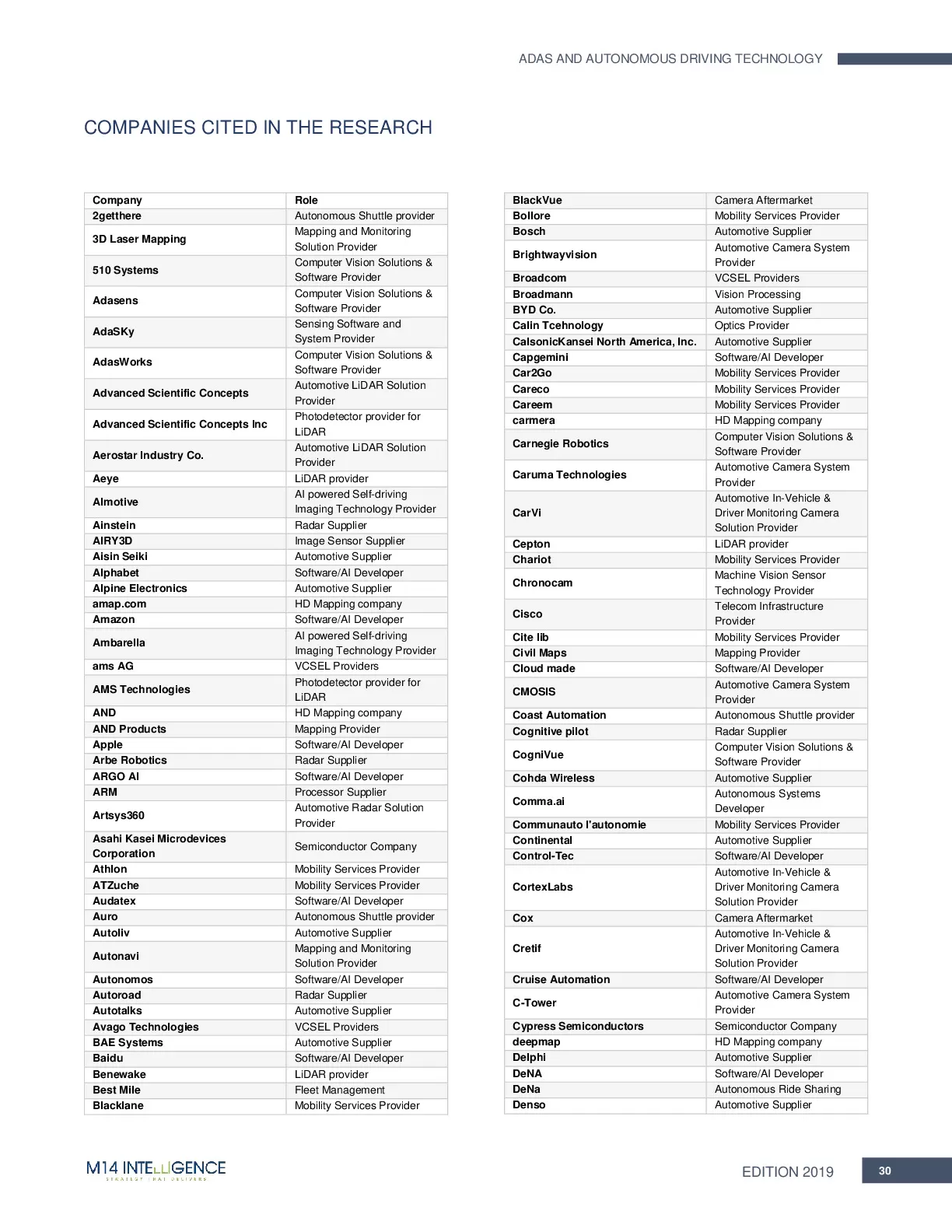

- More than 250 companies analyzed across supply chain

- 180+ data tables on penetration, sales demand, and pricing

- 150+ deep-level infographics on the market

- More than 120+ interviews conducted with key players

- Deep company profiles of more than 30 key players

- AV development analysis of 20 OEMs & 30 Tier 1 suppliers

- Regulatory framework across automotive markets

- Safety ratings by automotive regulatory authorities

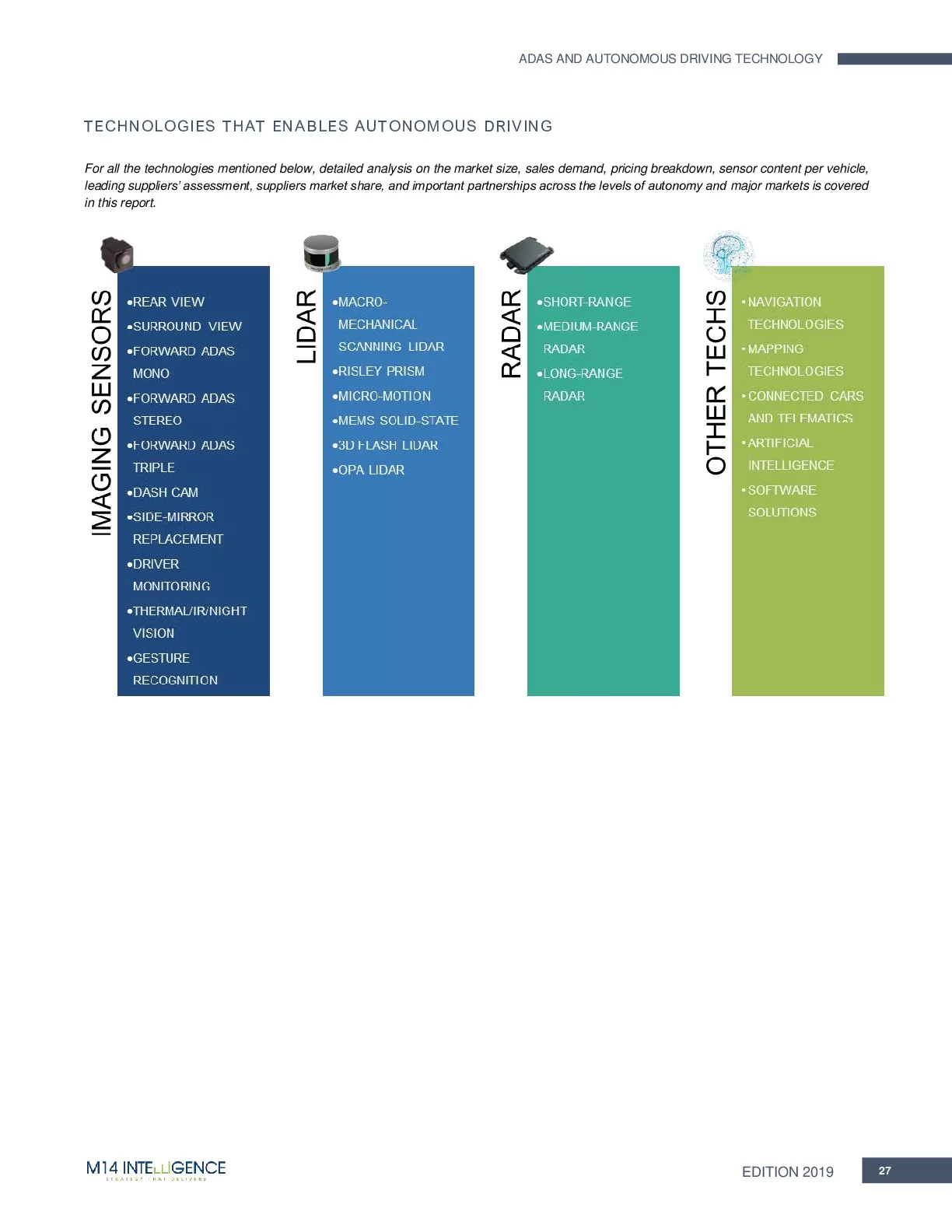

- Breakdown and analysis of 5 AV building blocks

- Market penetration and sales forecast by levels of automation

- Camera, radar, LiDAR, ultrasonic sensors market analysis

Exhaustive Coverage

Autonomous vehicles demand

Level 2 – Partial automation features – such as automatic cruise control, lane departure warning, emergency braking, among others

Level 3 – Conditional automation features – such as traffic jam assist and autopilot/propilot

Level 4 (highway traffic) – High automation features – such as highway autopilot and automated valet parking

Level 4/5 (urban slow-moving traffic) – Full automation features – such as automated valet parking and urban autopilot

The report focuses on penetration of automation features in both passenger and commercial vehicles industry. The passenger vehicles breakdown is by automation features developed and integrated by traditional OEM players in their production vehicles and automation in the form of robotaxis by new robotic vehicle companies. Similarly, in commercial vehicles automation in the LCVs (for delivery applications), autonomous shuttles, autonomous pods (goods delivery), and autonomous trucks (long-haul platooning applications).

CAV Enablers

2. Contextual information technologies for positioning and mapping including HA-GNSS, HD maps, and V2X communication

3. AI algorithms for learning the environment used in ML data annotation, testing, validation, and verification of AVs 4. Processing hardware including vision processors, AI chips, among others

The report gives a detailed analysis on each of these four technology blocks, their sub technologies, and their sub-component’s market size, shipment, and pricing forecast.

Industry analysis

Market Overview

The future scenario is expected to upend where every car will compulsorily have some or the other ADAS feature integrated. By 2030, ~XX million cars will be ADAS featured, ~XX million cars will be with Level 2 capability, ~XX million cars with Level 3 features, XX thousand cars will be highly autonomous, and XX thousand robotic vehicles.

Key Questions Answered

- What is the status of vehicle automation in 2018 and 2019? And how will it change over the period of next 20 years?

- Which markets are currently leading in vehicle automation and which markets are expected to make significant difference in the future?

- Which type of ADAS and Level 2 solutions are currently being developed by the Tier 1 suppliers and what kind of sensors are being used in such solutions?

- What is the penetration rate of SAE Level 1 and 2 in car sales across different markets in 2016 and 2017? And what is the expected penetration rate of SAE Level 3 and above solutions across different geographies and markets between 2019 and 2030?

- Which OEMs lead L2 deployment in 2018 and 2019 and why?

- What changes in 2019 in terms of deployment of L2 and L3?

- What are the regulatory and engineering challenges carmakers face for the deployment of higher level of vehicle autonomy?

- What is the status of autonomous driving regulation in major car markets?

- What are the differences in the legal and regulatory framework in Europe and the United States and how this will it affect L3-5 deployment?

- Which geography presents the most favorable environment for deployment of Level 3- 5?

- What breakthroughs are required in the area of SW/HW and validation for L3-5?

- How carmakers, Tier-1s and new-entrants, including tech giants plan to overcome the challenges and commercialize autonomous driving?

- How do leading OEMs plan to achieve L4/5 capabilities and when?

- What are the major OEM strategies, new business models and key collaborations?

- Why leading Tier-1s are well positioned to monetize ADAS growth?

- Who will lead and who will follow in the autonomous vehicle race?

- What are the trends by ADAS levels in Top Premium OEMs’ model range during 2018-19?

- Which are the recent mergers and acquisitions by the players across the ecosystem that has the potential to highly impact the autonomous driving market?

- What are the different sensor fusion technologies expected to launch in the recent future?

- Which type of sensors market among camera, radar, ultrasonic, and LiDAR will be highly profitable?

- What are the sales, market size, and pricing trend of sensing technologies in ADAS and autonomous driving market from 2019 to 2030?

- Which type of emerging sensing technologies will be a threat for the current technologies in the market?

List of Companies

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)