Edition 2025: 4D Imaging Radar in Autonomous Vehicles – Industry, Market, and Competition Analysis

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and above applications, Emerging 4D imaging players competition assessment

Published: 09 Jun 2025

Key Highlights

Exhaustive Coverage

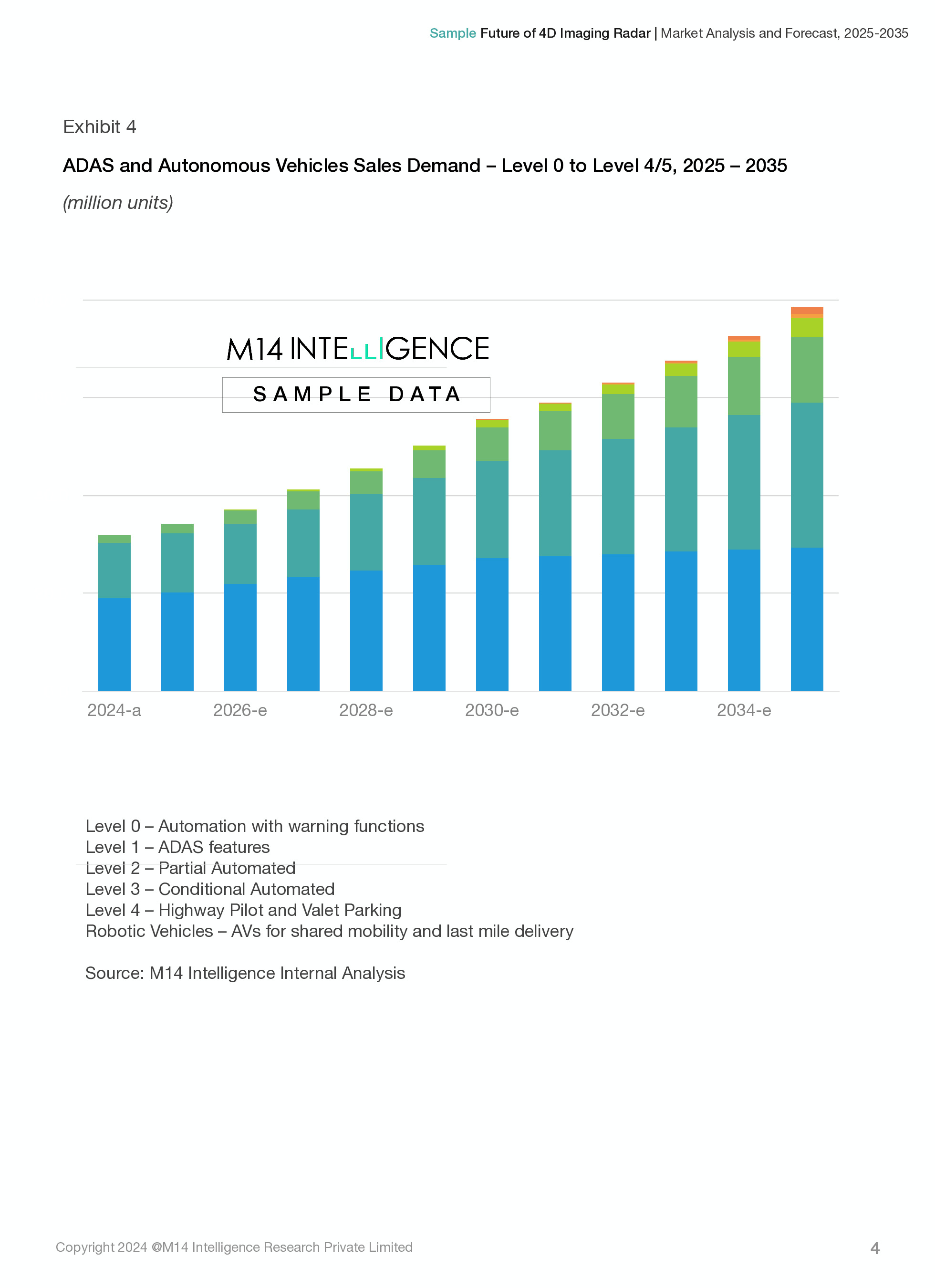

- ADAS, Autonomous and Robotic Vehicles – Market Outlook

- Status of radar sensors in the ADAS and AV industry

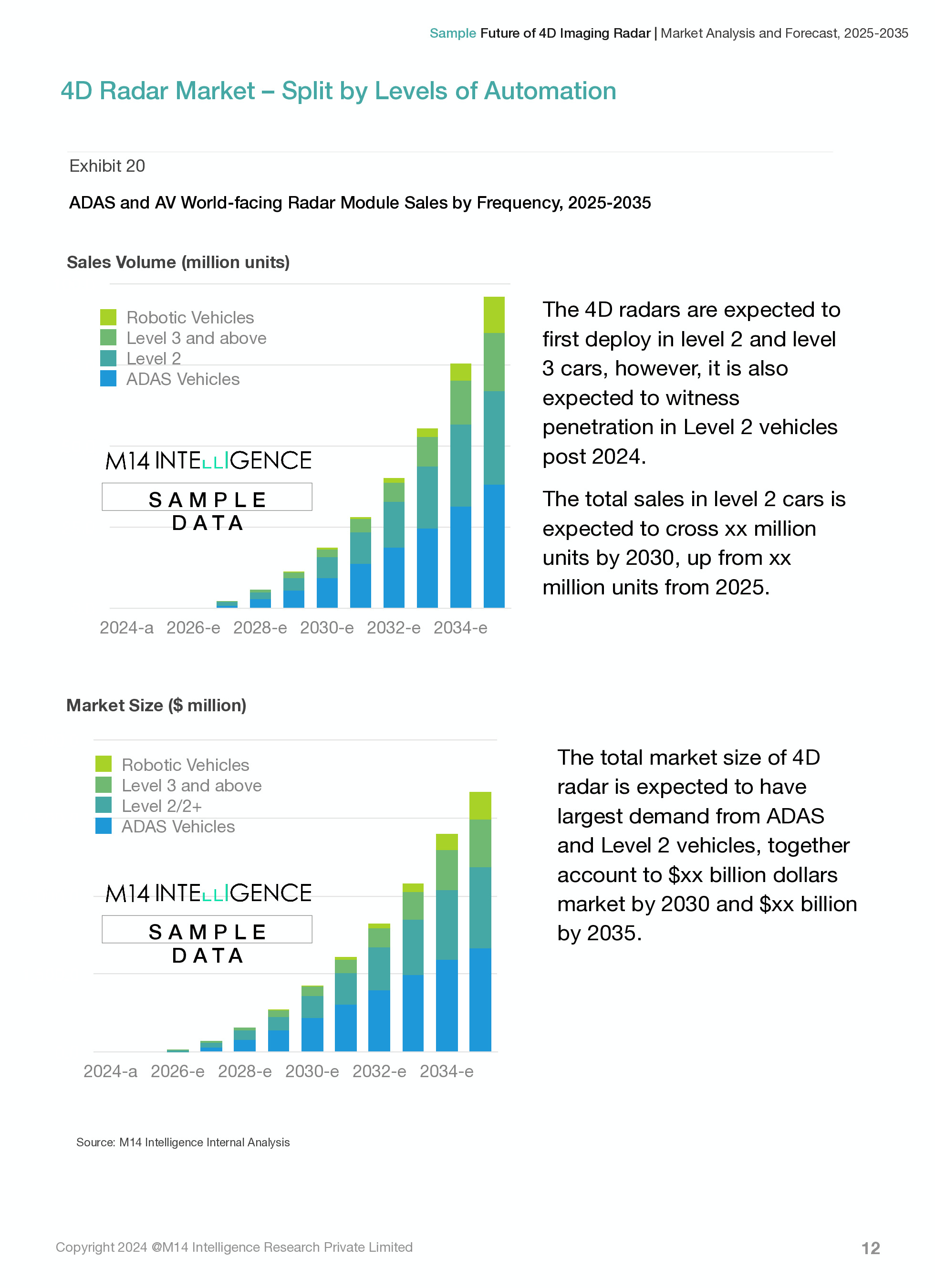

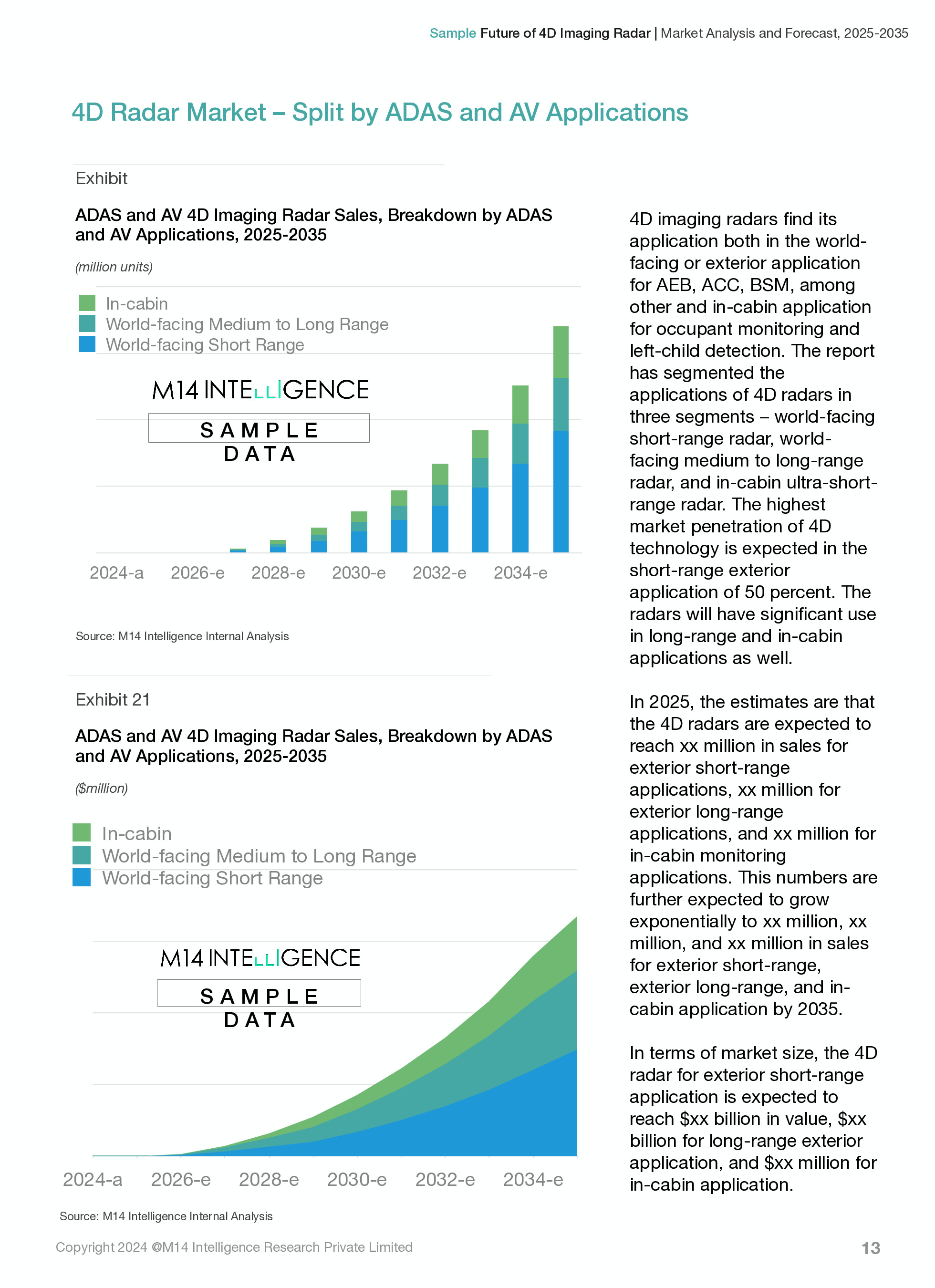

- Understanding the potential change in the radar demand and its market size from different perspectives including – automation levels (ADAS, Level 2/2+, Level 3 and Level 4/5), range of operations (short, medium-long), and frequency band of operation (60 GHz, 76–81 GHz , and 140GHz)

- Modulation Techniques- FMCW and Digital Code Modulation (DCM)

- Radar-on-Chip and MIMO antenna design

- AI-based processing

- Market penetration trend of 4D imaging radar-on-chip sensors for in-cabin and world-facing exterior sensing applications

- Impact of frequency regulations and allocations across different geographies

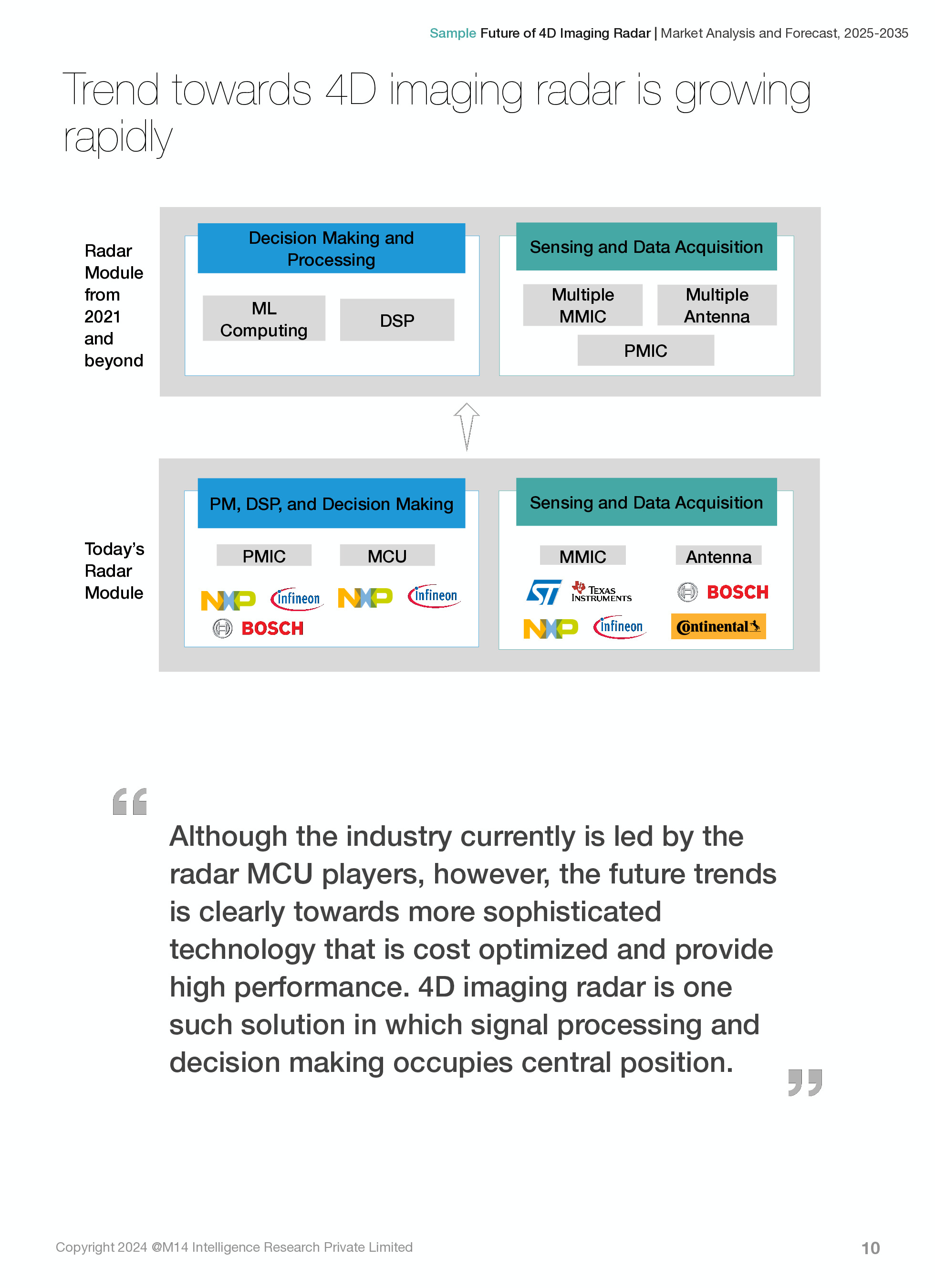

- 4D imaging radar hardware chip and software solutions and how it is expected to challenge the sensor suite dynamics

- Disruptive trends like AI integration, radar-on-chip, and sensor fusion that will reshape the market

- Challenges like high costs and integration complexities, and how advancements in semiconductors and software-defined radar are addressing these hurdles

- Competition assessment of emerging leaders and start-ups, along with the strategies and developments of chip providers and tier-1s offering solutions in automotive radar market.

Market Overview

Competitive Strategies and regional market opportunities

- Urban Mobility: High radar demand for navigating dense environments (e.g., Waveye’s urban-focused radar).

- Last-Mile Delivery: Autonomous shuttles and delivery vehicles adopting 4D radar for safety.

- Regulatory Support: Mandates for AEB and CPD boost radar integration in Level 4/5 systems.

Key Questions Answered

- How rapidly is 4D imaging radar penetrating autonomous vehicles across SAE Levels 1–5, and what are the adoption trends?

- What is the current market size and growth potential of the 4D imaging radar market for automotive applications through 2035?

- Which ADAS features (e.g., AEB, ACC, BSM) are most reliant on 4D radar, and how do they enhance safety and performance?

- How are 4D radar costs (e.g., 77 GHz, 60 GHz, 140 GHz) evolving, and what factors drive cost erosion for mass production?

- What are the challenges of integrating 4D radar with other sensors (e.g., LiDAR, cameras) for robust sensor fusion?

- How do frequency regulations (e.g., 77 GHz, 60 GHz, 140 GHz) vary globally, and what impact do they have on 4D radar deployment?

- How 4D radar’s role in in-cabin monitoring applications of occupant monitoring and left-child detection is creating market opportunity?

- Which emerging startups (e.g., Arbe, Uhnder, Zendar) are disrupting the 4D radar market, and what are their unique strategies?

- What are the competitive advantages of established players (e.g., Continental, Bosch, NXP) versus emerging startups in the 4D radar market?

- How are partnerships, mergers, and acquisitions shaping the 4D radar market, and what opportunities do they create for stakeholders?

- What investment and funding trends are supporting the growth of the 4D radar market, and how can stakeholders capitalize on them?

List of Companies

Ainstein

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)