4D Imaging Radar in Autonomous Vehicles – Industry, Market, and Competition Analysis

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published: 10 Aug 2021

Key Highlights

- ADAS and AV radar module market size anticipated to grow 1.6x times to reach $8 billion by 2025 and $12 billion by 2030, at a CAGR of 10.5 percent

- 4D imaging radar modules expected to penetrate by 6.8 percent by 2025; only in a matter of 2-3 years, which is currently a niche market

- Exterior application specially in the short-range applications such as blind-spot detection shows huge market potential along with in-cabin applications of occupant monitoring and left-child detection

- Vayyar Imaging, Arbe Robotics, Uhnder, RFISee, RadSee, Smart Radar System, Zadar Labs, Oculli, InnoSenT, Infineon, and Ainstein, are the leading emerging players in 4D imaging radar industry. While Texas Instruments, NXP Semiconductors, ST Microelectronics, Xilinx, and Analog Devices are the SoC providers aggressively working on developing 4D imaging radar solutions for ADAS and higher level of automation.

Exhaustive Coverage

- Impact of COVID-19 pandemic on the automotive sales

- Repositioning Chinese auto industry in the awake of pandemic

- ADAS, Autonomous and Robotic Vehicles – Market Outlook

- Status of radar sensors in the ADAS and AV industry

- Understanding the potential change in the radar demand and its market size from different perspectives including – automation levels (ADAS, Level 2, Level 3 and Level 4/5), range of operations (short, medium-long), and frequency band of operation (24 GHz, 77 GHz, 79 GHz, and in-cabin application bands)

- Market penetration trend of 4D imaging radar-on-chip sensors for in-cabin and world-facing exterior sensing applications

- Impact of frequency regulations and allocations across different geographies

- 4D imaging radar hardware chip and software solutions and how it is expected to challenge the sensor suite dynamics

Market Overview

Looking at the state of autonomous vehicles in 2021 there are many impressive milestones that have been achieved by companies such as Waymo, Baidu, Cruise, Aptiv, Yandex, Aurora, and Lyft among many others offering autonomous shared mobility solutions. At the same time, technology developers along with the OEMs are also witnessing unforeseen challenges

The total worldwide radar sales estimated in 2020 was 83.7 million units for passenger vehicles ADAS and autonomous driving applications. The sales are expected to witness growth by 16.7 percent in 2021 to reach 97.7 million, respectively. With the expected growth in the demand for level 2 featured passenger cars, the demand for radar is expected to grow by 12.1 percent, between 2021 and 2030.

The total sales of LRR in 2020 was 14.4 million units, which is expected to grow to 33.5 million units by the end of 2025. The demand is expected to grow as the rate of level 2 features deployment in passenger vehicles gain momentum. By 2030, it is estimated that the total sales of LRR will cross 61.3 million units.

Unlike LRR, the price of SRR or MRR is relatively cheaper, which makes it ideal for applications such as blind-spot detection and collision warning or assist system. On an average two SRR/MRR are used in level 1 vehicles, however, as the system level complexity increases, the number could increase to 4 or 5 depending on the level of automation. It is estimated that the total SRR sales will grow to 80.1 million units in 2021, witnessing growth from 69.3 million units in 2020. The growth potential is immense with the deployment of L2 and autonomous features in vehicles. By 2030, the total sales demand is expected to cross 195.6 million units, at an estimated CAGR of 10.4 percent, between 2021 and 2030.

The widely used 24GHz frequency band for short range radar is expected to be gradually replaced by 79GHz band, as the narrow 24GHz band is relatively weaker in object recognition and range detection.

Companies such as SmartMicro and Aptiv are already offering the SRR in 79GHz band majorly for blind spot detection, lane change assist and cross traffic alert. OEMs use combination of minimum 4 to 6 SRR and MRR to attain 360- degree horizontal coverage. BMW uses SRR& MRR from Continental for its level 2 models; few models of Honda, Jeep, and Mercedes uses Veoneer’s radar; Volkswagen uses SRR from Bosch and Hella.

The 79 GHz module is expected to witness high market penetration post 2022 with total sales expected to reach 35.7 million units by 2025. The 77 GHz module is expected to grow to 118.5 million units by 2025 and 163.7 million units by 2030, at an estimated CAGR of 13.5 percent, between 2021 and 2030.

Although the industry currently is led by the radar MCU players, however, the future trends is clearly towards more sophisticated technology that is cost optimized and provide high performance. 4D imaging radar is one such solution in which signal processing and decision making occupies central position.

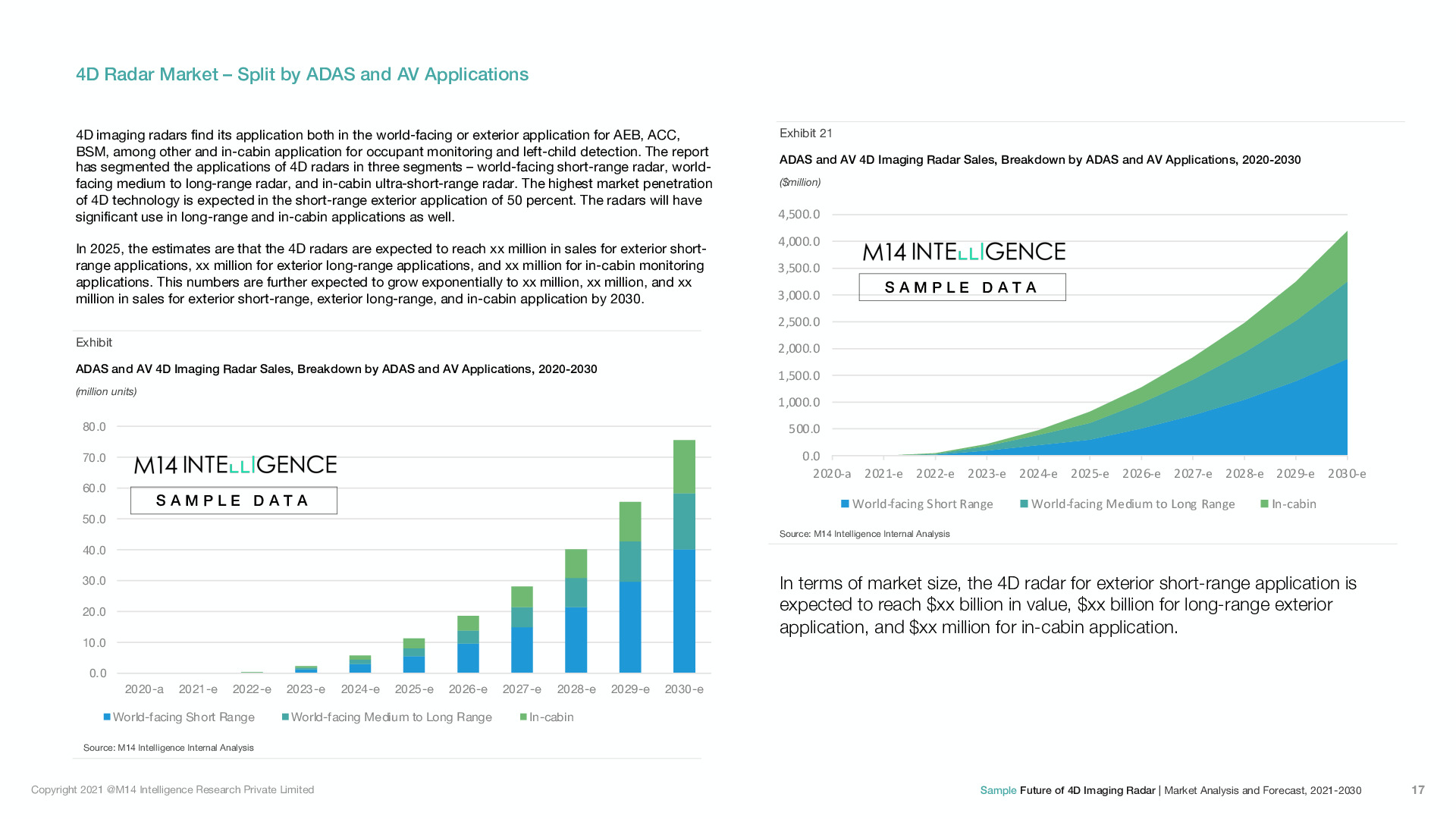

According to estimates, the 4D imaging radars are expected to witness initial deployment from 2020 with close to XX thousand units in sales. The sales are expected to pick up growth trends post 2025 with majority of AV companies, OEMs, and Tier 1s using 4D radars for world-facing and in-cabin monitoring applications. By 2025, the sales are expected to cross XX million units and is further expected to cross XX million units in sales by 2030.

The 4D imaging radar sensing technology is expected to penetrate at higher rate in the exterior sensing market and also hold potential to possible replace the conventional radar systems in coming years.

From the market adoption perspective, the radar sensor and semiconductor companies have already started using 79 GHz for medium and short range ADAS applications. Until the complete adoption of 79 GHz, 24 GHz SRR radar market is expected have smaller market presence. This change has offered unprecedented flexibility to the sensor players as it allows the integration of AI and other processing technologies with radar capabilities. All new entrants in the radar space have unveiled their products in 4D imaging technology space catering to short, medium, and long-range ADAS applications.

Several technologies are being adopted by players in this new radar domain. Multiple In Multiple Out (MIMO) antenna array technique, CMOS processing, FMCW technology, Phased Array, and solid-state technology are few of the major 4D radar imaging technologies being embraced by the sensor and chip manufactures.

Recently in April 2021, Vayyar Imaging Ltd., Valeo North America Inc., Infineon Technologies Americas Corp., Tesla Inc., IEE Sensing Inc., and Brose North America Inc. has received a waiver permitting the operation of radar-based vehicle cabin monitors in the 57-71 GHz band from the Federal Communications Commission (FCC or Commission). The permit is intended towards enhancing the passenger safety and theft prevention applications. These companies are the legal first movers in the in- cabin radar sensing space and expected to equip their systems in passenger cars by 2023.

For more detailed analysis on the 4D imaging radar market please download the sample document.

Key Questions Answered

- What are the major regulatory trends forcing towards adoption of 4D imaging radar?

- How radar sensor in the ADAS and autonomous vehicles industry is redefining its position?

- How important is 4D imaging radar software solution and what is its market potential?

- Who are the emerging and leading 4D radar-on-chip and software solution companies?

- How 4D radar’s role in in-cabin monitoring applications of occupant monitoring and left-child detection is creating market opportunity?

- What will be the potential demand for 4D radar sensors in exterior short and medium-long range applications?

- What would be the expected demand across different frequency ranges?

- What is the status and expected trends in autonomous vehicles industry?

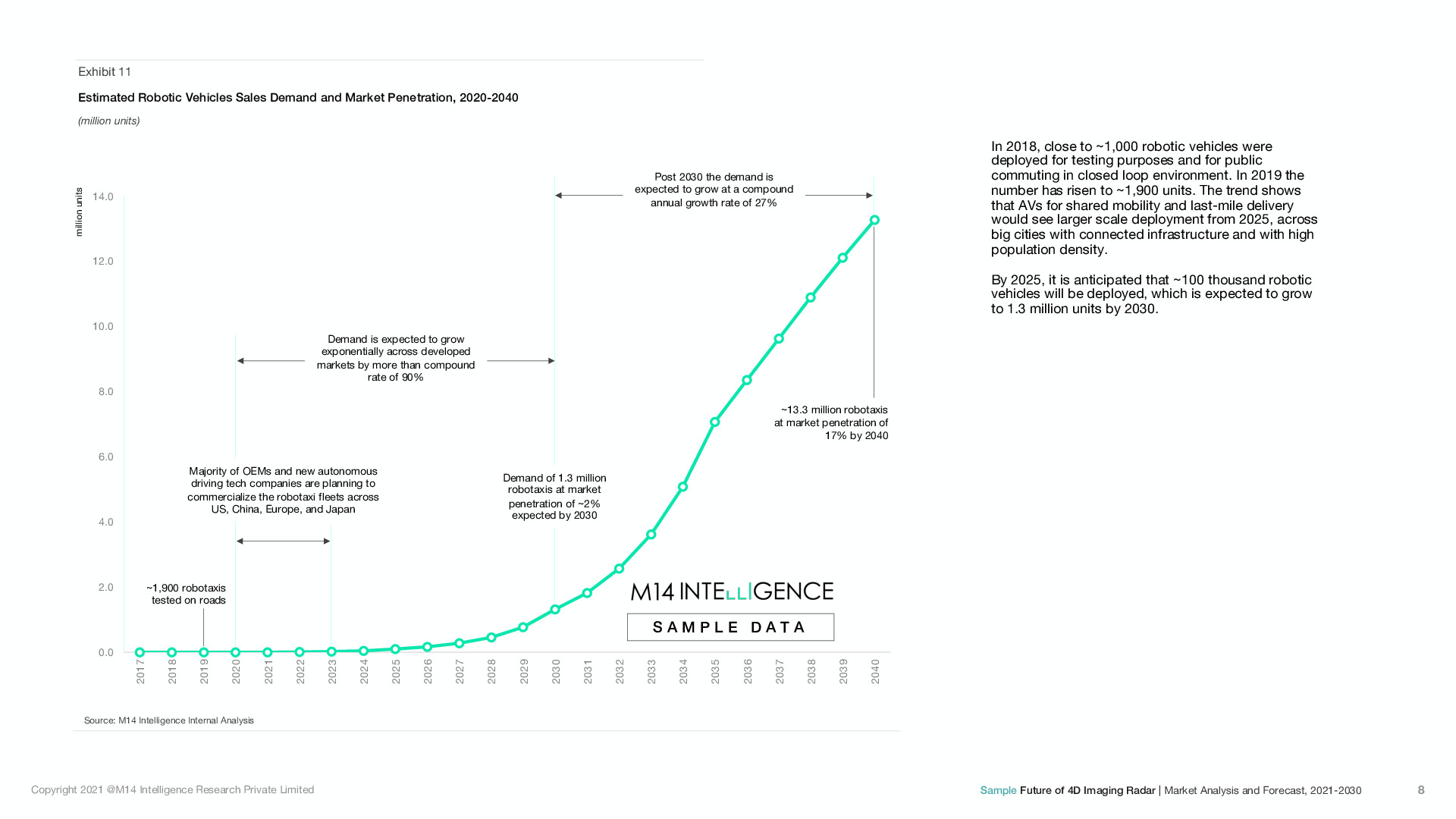

- What will be the expected demand of radar sensors across robotic vehicles for shared mobility and last-mile delivery?

- What are the partnerships within the industry (between OEMs, Tier 1s, and Tier 2s) for adoption and deployment of 4D radars?

List of Companies

This is not an exhaustive list.

Purchase the study

Individual Purchase

- For 1 user

- PDF copy only

- 1 month post-sales service

- NA

- NA

Company License

- For 2 users

- PDF + Excel

- 1 month post-sales service

- 15% Off on ACES portal subscription

- 8 hours free customization

Enterprise License

- Unlimited Users

- PDF + Excel

- 1 month post-sales service

- 20% Off on ACES portal subscription

- 15 hours free customization

Do you have any specific need?

Let us know your specific requirements

Contact ussales@m14intelligence.com | Worldwide Sales: +1 323 522 4865

Or request a call back !

Related Products

Published : 09 Jun 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76–81 GHz, and 140 GHz Band, SAE Level 2+ and ...

Published : 22 Apr 2025

Comprehensive Analysis of Service-Oriented Architecture (SOA), Over-the-Air (OTA) Updates, and Edge Computing in SDVs, Market Estimation and Forecasts...

Published : 28 Mar 2025

Lithium-ion (LFP and NMC) and Emerging Battery Technology (Solid-state and Sodium-ion) Market Sizing, Regional breakdown, Regulatory Policies, Battery...

Published : 05 Mar 2025

Driver Monitoring System (DMS) and Occupant Monitoring System (OMS) using Infrared (NIR), 3D sensing (VCSEL in ToF), Wide-angle Cameras, and Radar; in...

Published : 25 Nov 2024

Market Penetration & Sales Demand of Type of AMR - Inventory Transportation Robots, Picking Robots, Sortation Robots, And Drones for Inventory Managem...

Published : 04 Apr 2023

Autonomous Highway Trucks, Autonomous On-Road Vehicles, Sidewalk Robots/Droid, Market Penetration & Sales Demand, Consumer Analysis, Sensor Content (...

Published : 15 Mar 2023

Inventory Transportation Robots, Picking Robots, Sortation Robots, Collaborative Robots, And Drones; Market Penetration & Sales Demand; Market By Busi...

Published : 10 Aug 2021

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; Emerging 4D imaging players competition assessment

Published : 02 Jun 2021

Future of AI powered autonomous precision farming using agriculture robots; RaaS vs equipment sales; driverless tractors; computer vision image recogn...

Published : 21 Apr 2021

Mobile Robots, Sensing, Mapping and Localization Technologies, and Warehouse Automation Solutions Market Analysis, Forecast, and Automation Industry A...

Published : 09 Apr 2021

Container Terminal Automated Equipment, Sensing Technologies, Automation Solutions, and Services Market Analysis and Forecast, Company Assessment, Ind...

Published : 06 Apr 2021

Analysis of 150+ LiDAR companies and total addressable market in the field on ADAS, AVs, Robotaxis, Shuttles, Pods, Construction & Mining, Ports & Con...

Published : 22 Feb 2021

Active Driver monitoring and Occupant Monitoring System using NIR camera and mmW Radar; in-cabin 3D sensing market for ADAS and autonomous vehicles; O...

Published : 14 Oct 2020

Estimated automotive-grade LiDAR mass production timelines, expected pricing at high-volumes, & preferred technology by the leading OEM-Tier1-LiDAR su...

Published : 14 Jul 2020

ADAS and AV development, testing, verification, and validation with Image, Video, Data Annotation, Ground Truth Labelling, Automation Software and Man...

Published : 03 Jun 2020

ADAS and autonomous vehicles enablers shipment, market size, and pricing forecast breakdown by levels of autonomy – camera, LiDAR, radar, V2X, HA GNSS...

Published : 13 Jan 2020

Autonomous vehicles launch timelines by OEMs & robotic vehicle companies (robotaxi, shuttles, pods, long-haul platooning trucks); market penetration &...

Published : 09 Dec 2019

3D sensing camera modules and subcomponents (VCSEL, CMOS image sensor, optics, 3D system design and computing) market penetration, size, shipment, and...

Published : 05 Dec 2019

Cybersecurity application demand and market penetration in connected autonomous vehicles (CAV), pricing/costing models and business models adopted by ...

Published : 03 Sep 2019

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 10 Jul 2019

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

Published : 15 Sep 2018

Expected mass production timelines of LiDAR for autonomous driving, target cost, LiDAR technologies analysis, LiDAR supplier’s competition assessment ...

Published : 11 Jun 2018

Low & ultra-low power energy harvesting microcontrollers for wearables, medical devices, connected homes, precision agriculture, & smartphones. Blueto...

Published : 25 Jan 2018

Penetration & Sales Demand (Level 1+2; Level 3 – Highway Autopilot & Long-haul Platooning; Level 4 – Highway Autopilot, Park Assist, Urban Autopilot –...

.png)